Ready

Thinks s/he gets paid by the post

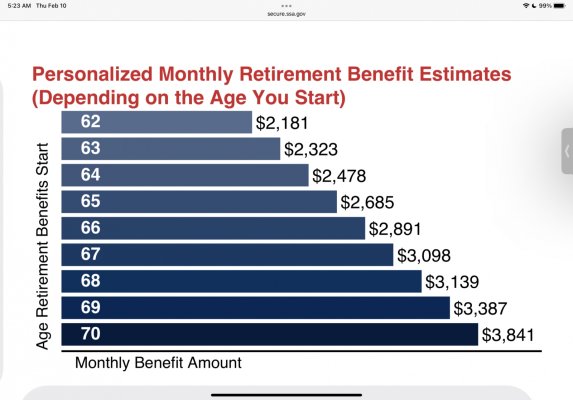

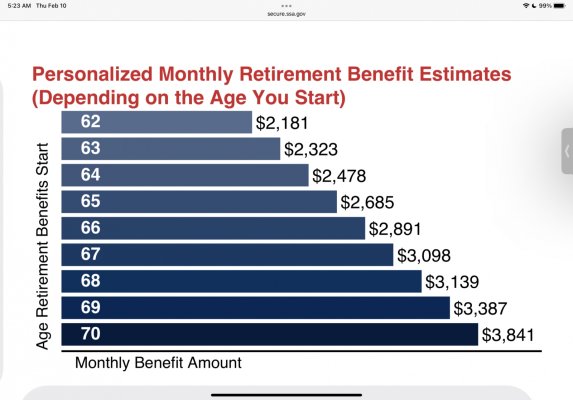

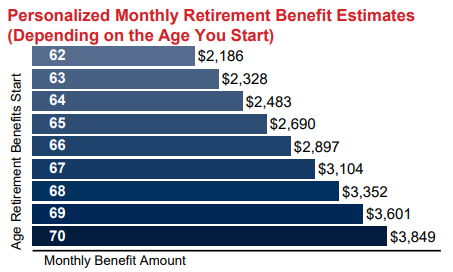

I was under the impression that from 67-70 my annual benefit goes up an even 8% each year but my latest statement shows these figures. Does this make sense? There is almost no increase from 67-68, a more modest increase from 68-69, then a huge jump from 69-70. This was pulled off of my current SSA online statement.