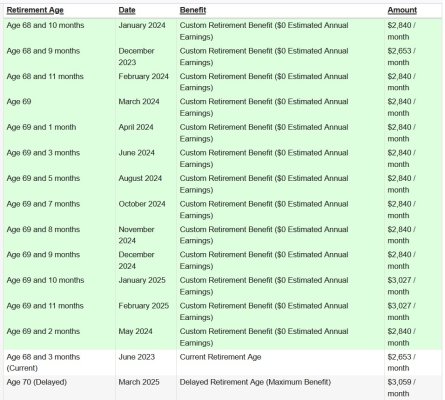

I'm looking at 'MySocialSecurity'. it shows a chart with my benefit.

The number stays the same from 68 and 10 months until 69 and 9 months.

Can that be correct? it does change for earlier and later.

Trying to decide if I want to start SS Jan of 2024.

The number stays the same from 68 and 10 months until 69 and 9 months.

Can that be correct? it does change for earlier and later.

Trying to decide if I want to start SS Jan of 2024.

.

.