Black Monday 1987

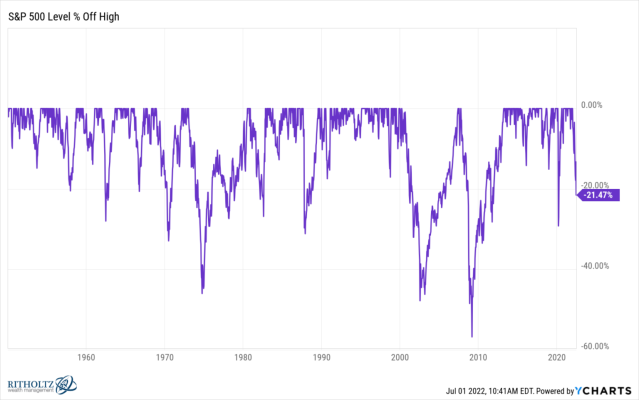

Black Monday is used most often to refer to the second-largest one-day percentage drop in stock market history. It occurred on October 19, 1987, when the Dow Jones Industrial Average dropped by 22.61%, falling 508 points to 1,738.74. The S&P 500 fell by 20.4%, dropping 57.64 points to 225.06. It took two years for the Dow to regain this loss.1

The stock market had been in a

bull market for five years. It had risen by 43% in 1987 alone, reaching a peak of 2,746.65 on August 25, 1987. It continued to stay in a slightly lower trading range until October 2. Then, it began falling dramatically. It lost 15% in the two weeks leading up to Black Monday.