urn2bfree

Full time employment: Posting here.

- Joined

- Feb 14, 2011

- Messages

- 853

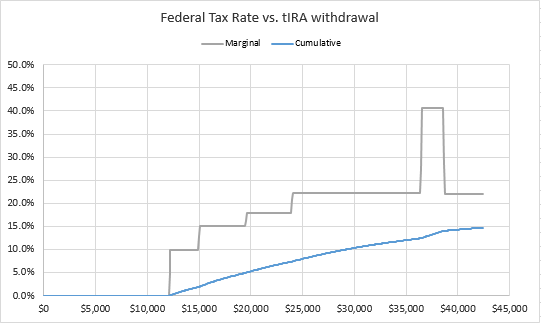

$15,000 -> 15% marginal tax rate

$20,417 -> 18%

$24,000 -> 22.2%

$36,865 -> 40.7%

$38,706 -> 22%

A married couple with $40K in SS will have the following marginal tax rates, depending on the non-SS income.

$21,733 -> 15% marginal tax rate

$24,000 -> 18.5%

$32,459 -> 22.2%

$56,941 -> 12%

$70,000 -> 22%

See: https://www.bogleheads.org/wiki/Taxation_of_Social_Security_benefits

I am not sure I understand the full effect of this. Or what you are saying.

Is the tax after the number what is taxed on the amount UP to that number or the amount taxed above that number? What do these numbers mean?

And while these rules are mind achingly complex, the use of marginal rates and big percentages only makes them more confusing.

How much actual money difference are talking about? It looks to me like maybe a few hundred dollars, but I confess I don't completely follow it.