... I have made it my mission to seek the best performing ETF's by category and I came up with the ones I listed in my original post of this thread. Those I listed I have equal percentages in each. ...

@Rjhasti, you sound a little frustrated in this post. I think I know the reason: You are looking in the rear view mirror to find funds that have performed well in the past. There seems to be an implicit belief in your posts: That past performance predicts future performance. It does not. Anyone who understands this will show little interest in the funds you talk about as "best." Best in the past, yes. Best in the future, not likely.

... I would love to get opinions from you all based on facts 'not because I like it' ...

OK. Standard & Poors tracks thousands of funds and publishes a couple of highly factual reports that pertain here:

The semiannual SPIVA report compares the performance of actively managed funds to their benchmark indexes. The results are always the same, though the percentages bounce around a little bit: Over 90% of actively managed funds underperform over a 10 year investing period. Performance is quite random over one year, trending steadily downward in subsequent years. You can understand this by reading the Ellis and Malkiel books I recommended.

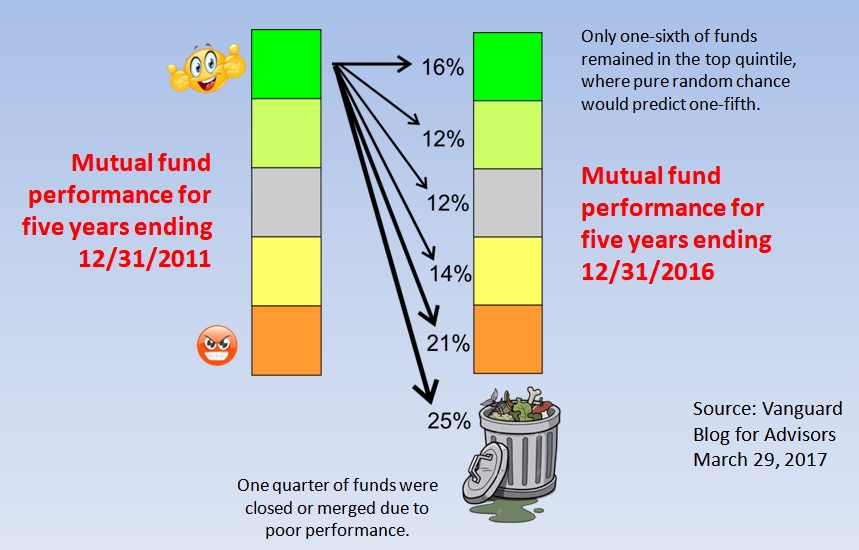

Closer to your specific interest, S&P publishes the Manager Persistence Report Card, also IIRC semiannualy. Persistence exists when a manager's historical performance "persists" into the future. Like the SPIVA report, the results here are always pretty much the same. There is no persistence over longer periods and apparent short-term persistence appears to be very random. Here is a chart I use in my Adult-Ed investment class:

On the left you see managers' ranked performance over a five year period. This is what you are doing, with S&P further concentrating on the top quintile/20% and showing these managers' performance in the

next five years. The results are pretty dismal, not even as good as random. These results are typical of the Persistence reports; there is nothing special about these periods.

... lets put them to the test with fundvisualizer.com and lets compare then to all the others in their category to see which ones are the best........I am up for the challenge.

I don't think you'll get many takers on this because most will probably see it, like me, as a waste of time. The experiment might be interesting to traders and speculators, but not to investors.

Here is a modification of your proposal that doesn't even require a computer: Take your set of funds and invest in each, recording the size of the investment. Wait ten years. See which have produced the best total return. (Be careful here; total return includes dividends. It is not just the value of the stock position at the end.)