Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Chicago Tribune

Not an in depth article, those interested have already read up, but a decent summary. We will all be impacted, maybe some more than others. Emphasis mine.

Not an in depth article, those interested have already read up, but a decent summary. We will all be impacted, maybe some more than others. Emphasis mine.

And the answer seems inescapable, the cycle will not be broken on it's own, until we really hit a wall (some cities have already gone under). Until we stop electing political leaders who tell us what we want to hear - even though we can all see the math shows otherwise, the hole just gets deeper. "We" continue to reject candidates who give us the bad news straight, while complaining why "they" (the candidates we voted for who told us 'no worries') don't do something!In state after state, elected officials have promised public employees retirement packages without securing the revenue needed to keep the promises. In Illinois, the state pegged its contributions below where they should have been for a long time. On top of that, lawmakers couldn't resist the temptation to borrow from the fund and skip contributions whenever it was convenient.

"Effectively, the state used the pension systems as a credit card to fund ongoing service operations," says the Center for Tax and Budget Accountability. The result is that now the state has large and growing obligations that exceed the money it has to cover them.

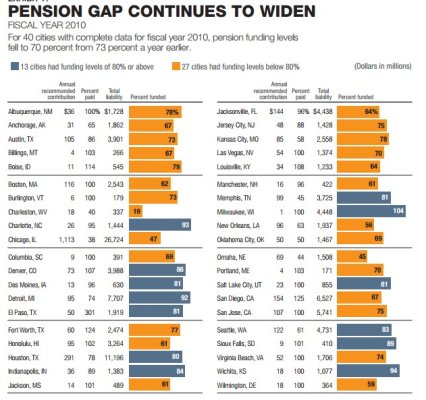

But there is plenty of company in this misery. More than 40 states have grappled with government employee retirement obligations in the past few years, but "many of them have simply deferred pension costs to the future," reports The New York Times. "And none have come close to closing their pension gaps quickly enough to keep pace with a rapidly aging — and retiring — public workforce."

Stanford University economist Joshua Rauh says that not only have the states not made progress on the issue overall, they have actually expanded the gaping canyon they dug. By his calculations, the distance between projected benefits and projected resources has widened from $3.1 trillion in 2009 to $4 trillion today. "I can't give you a good example of a state" that has closed the gap, another expert told the Times.

But something will eventually have to be done, and the shape of that something is easy to discern. Either taxpayers will be compelled to hand over more of their earnings to the government or workers who accepted the terms of their employment in good faith will get royally hosed, or both. Barring some miracle that provides a windfall to pension funds, someone will be eating a steady diet of dirt sandwiches.

Public pensions represent one of the biggest, worst and most inexcusable policy failures of our time. This is not like invading Iraq, where we might conceivably have created stability, or the financial meltdown of 2008, which surprised even the smartest experts. This is math, where numbers either add up or don't.

The failure is the sort that gives shameless political pandering a bad name. Politicians can gain favor from public employees by accepting contracts that promise generous pensions. They can indulge other constituents by diverting the money designated for pensions to current programs. They can appease taxpayers by holding down taxes in the near term.

They can also get re-elected over and over, knowing that future lawmakers and constituents will be the ones to pay the price.

Only an informed and alert electorate can prevent this kind of scam — and the complexity and dullness of the subject make such vigilance wildly implausible.

So when it comes to public pensions, elected officials have arrived at a formula that suits them well: Never do today what you can do tomorrow. And don't do it then, either.

Last edited: