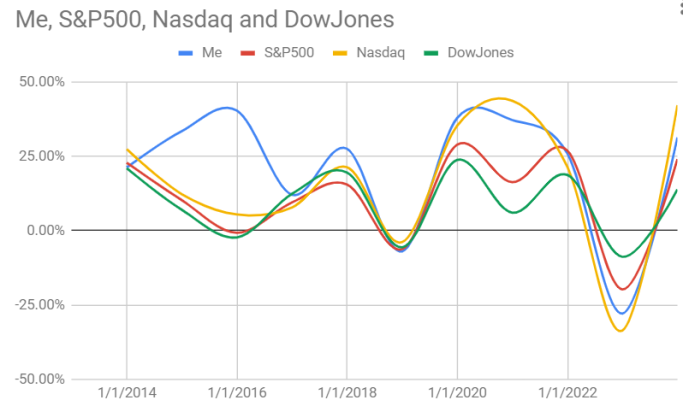

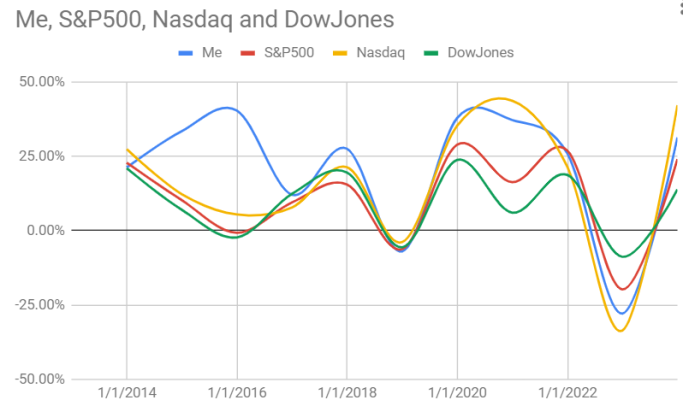

To answer your question frankly, I never paid an FA and I am never NOT beating the S&P. Okay that's an exageration, but look at the blue almost always outperforming the red on the graph. MOST of the time I am beating the S&P500.

I went into an FA (EJ) office in Hawaii back in 2014 arrmed with all my data, accounts, goals etc. We had a fun 15min conversation that ended with...you don't need me.

This is what I've managed to do SINCE that sit-down with the FA on my own.

My current expense ratio is .06% and that is my peak expense ratio as the cost of Vanguard ETFs slowly crept up the past few yrs.

That means for every $1mm I have invested I only pay $600 to manage it myself...vs what maybe a 1 to 1.5% management fee, ($10k -15k a year) if you pay an FA.

I had this same thought probably back in 2014... "Can they beat the S/P500, are they beating S/P500?" That introspection led me to invest in AAPL...a high flying tech company at the time.

Today I have 37% of our assets in AAPL. Probably close to 50% in the Magnificent 7...I'll have to do the math sometime on that.

All I know, is that I am invested in companies that beat the S&P500 and you can be too!