Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

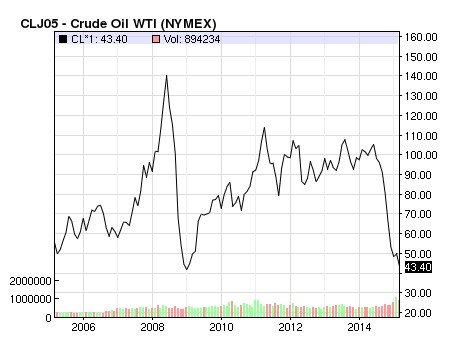

Things have changed rapidly the past couple years, Brat. The U.S. has actually become the number one producer of oil in the world. Of course if prices continue to drop, that may not last.

http://www.investopedia.com/articles/active-trading/100714/worlds-top-oil-producers.asp

Sent from my iPad using Tapatalk

http://www.investopedia.com/articles/active-trading/100714/worlds-top-oil-producers.asp

Sent from my iPad using Tapatalk