It is interesting data and no doubt non-trivial. He seems like a pretty straight shooter. I only asked because perma bears (which I define as somebody who has been bearish more than 3/4 of the time for the last 10-20 years) can be selective in how they present data.

You can read his two books, as well as many of his articles on his website. I would say that if being bearish 3/4 of the time over the last 10 years makes a permabear, he likely is one, though really it would not be fair to call him a bull or a bear. He says-"here is my data". "Here is why it is relevant". Then you as an investor or money manager or banker can decide what if anything this means to you. Most "investors" prefer a more authoritarian approach. Just give me the executive summary dammit, do I buy, sell, or hold?

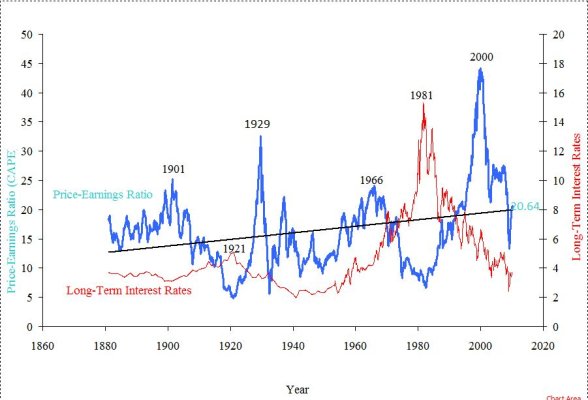

All of these serious minded people who use RTM approaches are frequently criticized because they missed this or that bull phase. But that is not fair, they don't say that the market will go down, or even that it will stop going up from whatever level. They only say that according to this set of data, this has always been a risky valuation level. Smithers goes a bit farther and gives a mechanism by which the markets shoud re-create equilibrium.

Remember too, it's not like he created the Q ratio. Irving Fisher did that long ago. All the data is publically provided, with some lags. So you can just avoid anything that Smithers says, and look to the data. However I would recommend reading his 2000 book,

Valuing Wall Street, to see if the thesis makes any sense to you. You may decide that it is ridiculous. Plenty people obviously have so decided, either explicitly more likely implicitly.

Any "return to the mean" hypothesis presents one basic difficulty-"Is it different this time?". Generally people decide that it is. And this is clearly literally true. Everything is always different, as we do not live in a static world.

It's just human nature to extrapolate a trend. When markets are going up, few want to hear that they will again be going down at some unspecified time in the future. What history do you include? US since WW2? US for as long as data is available? What US data will you admit? Do you look at other countries? In the case of Q, you can't because the non-price data is not available.

All sorts of reasons will always be presented as to why it is different this time, and who can say that they will prove to be irrelevant?

Ha