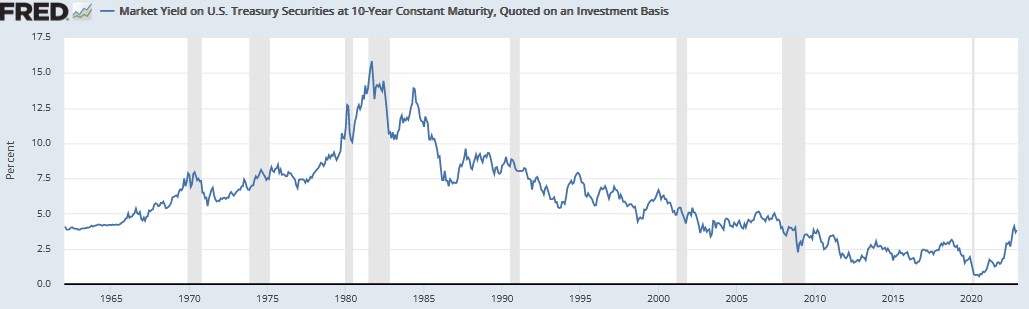

I’m looking at Fidelity’s site and see three month T-Bills earning just over 4.5%. So I’m asking myself, why shouldn’t I move the bulk of my investments into a short term bond ladder for 2023. Is there any belief that the equities market is going to deliver that level this year? I know we don’t know the future, but 4.5% is pretty good and personally, I don’t feel the market will have a positive return this coming year. Thinking about 75% in a bond ladder.

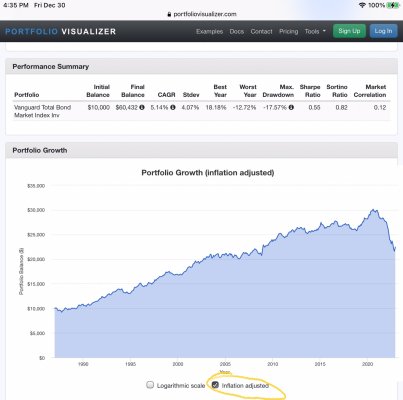

In a similar vein, I know I’m late to the party (funeral), but I don’t think there’s any reason to believe interest rates are going down and I’m sick of watching my bond funds decrease so at a minimum I need to move everything out of my funds and into individual bonds.

In short, I need a better plan for 2023 than to hold tight and watch my portfolio shrink.

FWIW, 2023 is the start of a new financial reality for DW and I. We both start SS this month and that, with my pension will cover our spending budget. So, other than major lumpy expenses like a new roof or whatever, we should not need to draw from our investments. The house and vehicles are in really good shape so I don’t foresee and significant expenditures in the next few years.