The annual Medicare Supplemental Plan renewal period is coming up.

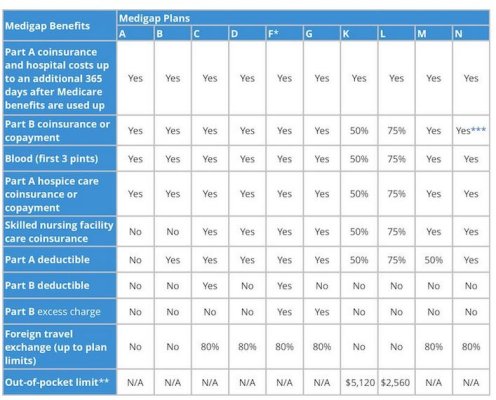

Chris Westfall of www.SeniorSavingsNetwork.org now suggests consideration of Plan N for Supplemental coverage due to predicted lower premiums (up to 30% less) going forward than the currently-popular Plans F and G.

As of Jan. 1, 2020 a new law (MACRA) will be going into effect which will make Plan G guaranteed issue and thus drive up annual Plan G premiums much like Plan F has had (which has been guaranteed coverage for a while).

Details explained in his video: https://plannmedicare.org/

omni

Chris Westfall of www.SeniorSavingsNetwork.org now suggests consideration of Plan N for Supplemental coverage due to predicted lower premiums (up to 30% less) going forward than the currently-popular Plans F and G.

As of Jan. 1, 2020 a new law (MACRA) will be going into effect which will make Plan G guaranteed issue and thus drive up annual Plan G premiums much like Plan F has had (which has been guaranteed coverage for a while).

Details explained in his video: https://plannmedicare.org/

omni