I enjoyed reading through this thread. What I like is all the different perspectives. I think hearing different peoples perspectives and opinions is more insightful then if everyone is in agreement.

Someone on here made a very wise statement. You don't have to make the when decision now unless it is at 62. You can go on year by year or even month by month evaluating based on your situation and decide when to make the plunge

Everyone's situation is different. Opensocialsecurity.com is a great site and recommended I take it at 70 with my wife at 66. She should then file for spousal support at 70. The difference though was around $100K over lifetime taking it at 65 vs 70 per their model.

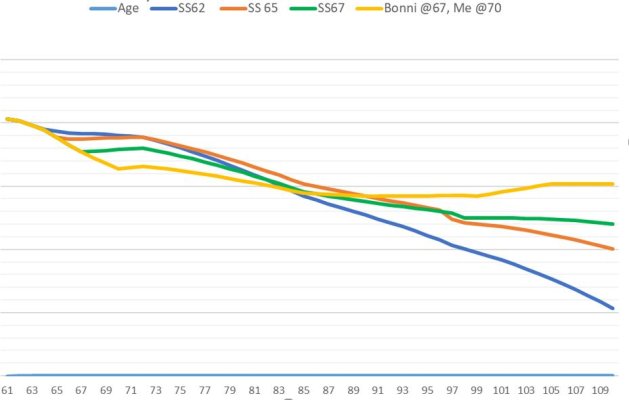

I then modeled in my spread sheet 4 scenarios, 62, 65, 67, and 70 with my wife taking hers at 67. All had spousal benefits

I assumed tax rates would go up in 2026

I looked at a very conservative ROI of 2.5%

I included my pension

I added my RMDs based on projected balances to the IRS table

There are several years I can live on pension and cash so I can do Roth Conversions to 12%.

Other scenarios showed different curves and break even points, but this one showed taking it at 65 was best up until age 91, and then 67 and 70 were better. In the scenario where I did not do Roth's and didn't live off of cash for a few years, the breakeven was 83-85

Yes I modeled to age 110, I am optimistic

So what am I going to do with this data? I am 60 so I will relook at it every year. If it still shows the same thing at 62 then I will wait and relook every year until I decide to file. I don't take this as the absolute truth, but it does suggest taking Roth's to 12% will reduce my RMDs which will reduce my tax burden. That isn't the decider, but a variable to when I should take SS

Taking SS at 62 doesn't give me those few years to live off of cash is what I see to maximize my Roth contribution to 12%. I don't have enough cash to do this past 64 so why 65 starts looking good.

That's just me and one scenario I could go down. Other scenarios change the answer, but I don't have to make the decision now and can wait and see what the market does and how much I spend over the next few years.