aja8888

Moderator Emeritus

Didn't Warren Buffett just say his buying IBM was a mistake?

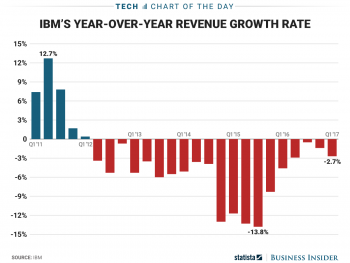

Exactly, that's why he sold most of it. IBM revenue is not rising due to maintaining legacy systems and no new blockbuster products to create more demand. The only thing that has been helping earnings is the lower dollar impact. IBM is one of the crowd that is marketing "blockchain" technology and is working with several European banks to develop a system, but has not signed any contracts for that technology implementation.

There is not a lot of good news for IBM's future.

But he has a few million, so if he gets taken for a few hundred thousand he probably won't even know it.

But he has a few million, so if he gets taken for a few hundred thousand he probably won't even know it.