Ditto this. I'm ~100 days from ER (54 1/2) and worry about sequence of returns risk a LOT. For that reason and that reason alone, I'm downshifting my equity allocation and increasing cash. Unfortunately, I didn't do as much of this as I planned for tax and other reasons and now have a 'bunny market' that is making re-allocation much more difficult.

3-year brokered CDs are pushing 3%, and the interest from our cash allocation + dividend paying stocks is pretty much all we need to pay (most of) the bills. Plus, DW is ~5 years from SS which will also help with cashflow. I'd love to make a ton more $$ on the upside so that I can travel a lot, buy whatever toys I'd like, etc, but 100 days from RE I'm all about protecting the downside and what we've already accumulated.

I realize cash won't make us rich, but am 50+% cash on our overall PF. (That'll pretty much get you laughed off the board on Bogleheads, but is what makes me comfortable). Most of that is in CDs. Some in MM. Either way, we can survive a pretty long bear without selling a single dollar in our investment portfolio. Still keeping $1M+ "invested" but at over 50% cash I feel a whole lot better about what might come.

All that said, I still get stressed about the "total number" on the spreadsheet. It's comforting to see a relatively safe # before ER. If that # were to drop precipitously right before ER, that'd suck and stress me out to the max..but at least we have our cash kitty to fall back on - and we're already covering the majority of our expenses through dividend paying stocks and interest from brokered CDs.

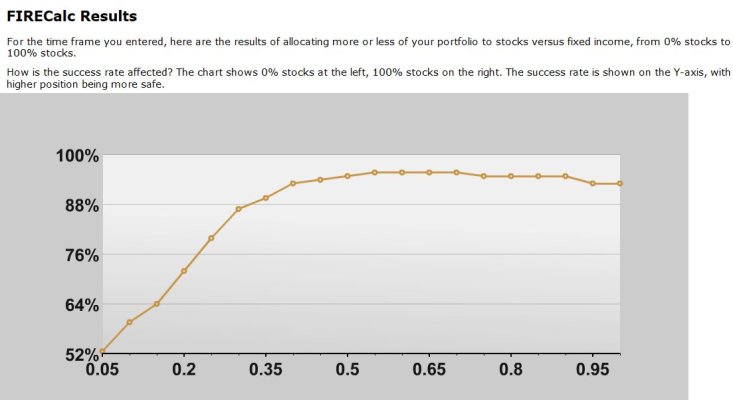

As others have said, it all comes down to your comfort with risk. Bernstein said it best - "if you've won the game, quit playing". My problem is I love investing - the science of it, the research, the return, etc. But I do also think the glory days of the market are behind us for at least the next decade - and that's not good with going into ER this year. How there are people here 60, 70, 80, 90 or even 100% stock is beyond me. Maybe they have not 'won the game' yet but memories of 2008 are still very fresh and a 50% drop in my PF would potentially kill me - so, I prefer to limit the upside and protect the downside. Tortoise and Hare. The Tortoise wins every time.