RetirementOrDieTrying

Confused about dryer sheets

- Joined

- Feb 20, 2023

- Messages

- 4

Greetings, all. This is kinda long, as I'm taking the advice of this forum's sticky post to be verbose in my introduction. Reckon what the buffer of this input window is?

I'll start by saying that my position is incongruent with the name of this site, but because of my (remaining) timeline, the sprint is about the same, so I look forward to absorbing ideas from the conversations here.

This is a story of how a gut-wrenching divorce had a silver lining, with a couple of requests for input following the intro.

3.5 years ago I found myself divorced at 50 and with a big ol' load of debt from the former spouse, with whom I was not in alignment from a fiscal posture standpoint. She believed that there was no such thing as debt-free, and so there was no point in worrying about it - simply spend what you want and let tomorrow take care of itself. YOLO, right?

That is very nearly a direct quote, by the way.

At the end of June 2019 I started life over with $25 in savings and $400 in checking (those are not typos); $115k in unsecured debt (read: credit cards completely maxed out). No home = no equity. No vehicle of any kind. Nothing to sell. An RV in which I was living, with an $1,800/mo. payment (plus insurance), and which was upside down, so I couldn't get out of it by selling. All debt had been put in my name, because her credit was worthless. This debt included obligations from her prior marriage, with which I was stuck.

My brother had a spare ancient, 25-year-old GMC Yukon which he gave me. It had almost 200k miles, the paint had been baked off and looked terrible, but it ran and was road-legal, so for it I was enormously appreciative in my hour of need.

I was at a job in which I'd been for almost 20 years. I made $117k/yr. Because of the enormous debt load and profligate spending of my former spouse, I had zip-all in retirement or any other kind of savings, and I lived absolutely hand-to-mouth.

About the only thing I had going for me was that I was unbendingly determined to never have missed or late pays on anything - EVER. My credit was better than you might think based upon the above description of my plight, because although my DTI ratio wasn't great, my credit history was absolutely stellar. I couldn't stomach the thought of default interest rates and late fees.

By living as far below my means as humanly possible (and with no spouse blowing every dime), I slowly began to claw back some of the debt. $115k spins off a lot of interest at credit card rates, and it was hella difficult to make progress at first because interest was swallowing me alive. It took a year to pay off the first $32k account, and I kept pounding away one by one.

Along the way a friend of mine counseled me to start my 401k and HSA, even if it meant adjusting my timeline for debt repayment.

The RV was refinanced from 8.99% to 3.69%. Same payment, but the length of the loan went down from 30 years to 10.

I changed jobs, going from $117k/yr. to now about $220k/yr.

I paid off every last cent of debt except for the RV. I'm not super keen on early repayment of 3.69%. That's cheap money.

Even with the awful current market keeping the numbers depressed, I have $8k in HSA (which I do not ever touch), $85k in 401(k), $22k in Roth IRA, $26k in emergency fund, and I'm still driving that now-28-year-old GMC.

Although I have no fixed living location (I wander around the U.S. with a fully-remote job), I am domiciled in Texas, so no state income tax nor personal property tax.

My RV loan is $160k/3.69%, with 8.5 years left at $1850/mo. payment.

My FIT, FICA, MC, etc. is about 18% of gross on average.

My living expenses, including RV payment, insurance, fuel, food, clothing, maintenance, etc., is running about 21% of gross on average.

This leaves me with a smidge over 60% of gross as my current savings rate.

I completely max out my HSA, my 401k (including catch-up), and my IRA-to-Roth conversion, so my tax-advantaged buckets are all getting topped off as early in the year as possible.

I'm just now at the point where I've gotten all that debt killed off, my buckets are full, and my emergency fund has a few bucks in it. Time to turn my attention toward where to put extra dollars now.

So, there's all of the background. Now to my strategy queries...

1) I'm still driving that GMC, and happy to do so. I got it painted, so it looks very nice, and I maintain it well. It's comfortable, quiet, and reliable. Repairs and maintenance are running about $110/mo. on average. I have not been evaluating the cost of repairs vs. resale value, as I'm not in the auto business. This is an expense, not an asset nor inventory item - I couldn't care less what the trade-in or resale value is or will ever be. Am I overlooking something with this line of thinking?

2) I am woefully ignorant of the ways to make money work for me. To begin with, it has been suggested that I keep it simple and start with e.g. Vanguard mutual funds while I work on my financial knowledge. Thoughts on this approach?

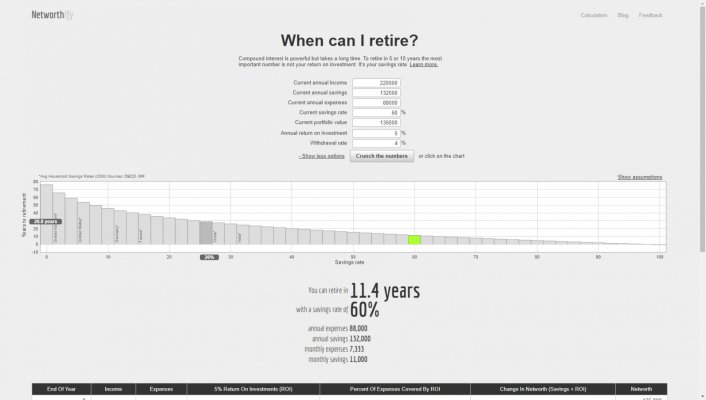

3) I'm not entirely sure what my retirement trajectory is. A lot of the tools start with "when do you want to retire?", and "before I die" isn't one of the options. I live very modestly, and don't anticipate that changing, but lately with inflation, the specter of SS insolvency, and so forth, I'm really struggling to come up with a data-driven date that I can work toward. What are some ways I can get a handle on my realistic timeline for retirement, by working the numbers backward?

I live very modestly, and don't anticipate that changing, but lately with inflation, the specter of SS insolvency, and so forth, I'm really struggling to come up with a data-driven date that I can work toward. What are some ways I can get a handle on my realistic timeline for retirement, by working the numbers backward?

If you've read this far, then I appreciate the time, and would welcome input.

I'll start by saying that my position is incongruent with the name of this site, but because of my (remaining) timeline, the sprint is about the same, so I look forward to absorbing ideas from the conversations here.

This is a story of how a gut-wrenching divorce had a silver lining, with a couple of requests for input following the intro.

3.5 years ago I found myself divorced at 50 and with a big ol' load of debt from the former spouse, with whom I was not in alignment from a fiscal posture standpoint. She believed that there was no such thing as debt-free, and so there was no point in worrying about it - simply spend what you want and let tomorrow take care of itself. YOLO, right?

That is very nearly a direct quote, by the way.

At the end of June 2019 I started life over with $25 in savings and $400 in checking (those are not typos); $115k in unsecured debt (read: credit cards completely maxed out). No home = no equity. No vehicle of any kind. Nothing to sell. An RV in which I was living, with an $1,800/mo. payment (plus insurance), and which was upside down, so I couldn't get out of it by selling. All debt had been put in my name, because her credit was worthless. This debt included obligations from her prior marriage, with which I was stuck.

My brother had a spare ancient, 25-year-old GMC Yukon which he gave me. It had almost 200k miles, the paint had been baked off and looked terrible, but it ran and was road-legal, so for it I was enormously appreciative in my hour of need.

I was at a job in which I'd been for almost 20 years. I made $117k/yr. Because of the enormous debt load and profligate spending of my former spouse, I had zip-all in retirement or any other kind of savings, and I lived absolutely hand-to-mouth.

About the only thing I had going for me was that I was unbendingly determined to never have missed or late pays on anything - EVER. My credit was better than you might think based upon the above description of my plight, because although my DTI ratio wasn't great, my credit history was absolutely stellar. I couldn't stomach the thought of default interest rates and late fees.

By living as far below my means as humanly possible (and with no spouse blowing every dime), I slowly began to claw back some of the debt. $115k spins off a lot of interest at credit card rates, and it was hella difficult to make progress at first because interest was swallowing me alive. It took a year to pay off the first $32k account, and I kept pounding away one by one.

Along the way a friend of mine counseled me to start my 401k and HSA, even if it meant adjusting my timeline for debt repayment.

The RV was refinanced from 8.99% to 3.69%. Same payment, but the length of the loan went down from 30 years to 10.

I changed jobs, going from $117k/yr. to now about $220k/yr.

I paid off every last cent of debt except for the RV. I'm not super keen on early repayment of 3.69%. That's cheap money.

Even with the awful current market keeping the numbers depressed, I have $8k in HSA (which I do not ever touch), $85k in 401(k), $22k in Roth IRA, $26k in emergency fund, and I'm still driving that now-28-year-old GMC.

Although I have no fixed living location (I wander around the U.S. with a fully-remote job), I am domiciled in Texas, so no state income tax nor personal property tax.

My RV loan is $160k/3.69%, with 8.5 years left at $1850/mo. payment.

My FIT, FICA, MC, etc. is about 18% of gross on average.

My living expenses, including RV payment, insurance, fuel, food, clothing, maintenance, etc., is running about 21% of gross on average.

This leaves me with a smidge over 60% of gross as my current savings rate.

I completely max out my HSA, my 401k (including catch-up), and my IRA-to-Roth conversion, so my tax-advantaged buckets are all getting topped off as early in the year as possible.

I'm just now at the point where I've gotten all that debt killed off, my buckets are full, and my emergency fund has a few bucks in it. Time to turn my attention toward where to put extra dollars now.

So, there's all of the background. Now to my strategy queries...

1) I'm still driving that GMC, and happy to do so. I got it painted, so it looks very nice, and I maintain it well. It's comfortable, quiet, and reliable. Repairs and maintenance are running about $110/mo. on average. I have not been evaluating the cost of repairs vs. resale value, as I'm not in the auto business. This is an expense, not an asset nor inventory item - I couldn't care less what the trade-in or resale value is or will ever be. Am I overlooking something with this line of thinking?

2) I am woefully ignorant of the ways to make money work for me. To begin with, it has been suggested that I keep it simple and start with e.g. Vanguard mutual funds while I work on my financial knowledge. Thoughts on this approach?

3) I'm not entirely sure what my retirement trajectory is. A lot of the tools start with "when do you want to retire?", and "before I die" isn't one of the options.

If you've read this far, then I appreciate the time, and would welcome input.