Aiming_4_55

Thinks s/he gets paid by the post

So this last year has been pretty interesting as I shifted from full time employment to contract work (more pay, less stress - worked about 40 hours a week with some telecommuting and taking 3 weeks of vacation). At age 44, I reached FI based on a modest lifestyle in St Paul, MN with income producing rental properties.

Basically, my family’s annual expenses range from $55-60k (no mortgage or car payments) and I netted $60k rental income after all expenses/vacancies. This is my part time job as I perform most property management and minor maintenance/repairs, but hiring out major repairs.

Besides rental properties, other assets: primary residence is paid in full, $1.2M in savings, taxable investments, and retirement funds along with a small annual pension of 13k, non-cola, at age 55 and SS in the future. Two college funds with a fair amount saved (total currently $80-90k), but will continue to fund for a few more years to a target of $150k, while letting the market work some magic the next 10 - 12 years. The international travel fund can always use more $$ as DW and I are young and interested in more travel in the future. No debt at this time.

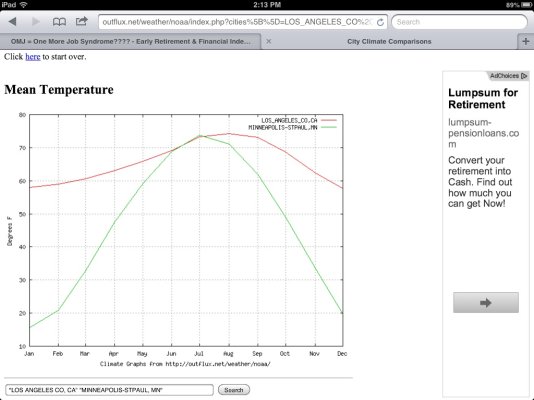

Here is my personal dilemma; a variation to OMY is my OMJ syndrome…. OMJ = One More Job. While I’ve enjoyed the contract job, I felt bored and not really challenged. I have a new opportunity in an area of technology (SaaS using cloud computing) that I’m excited to learn. The downside is the job is located in Los Angeles, CA, a much higher cost of living area. By renting out our primary residence, out of pocket CA rent would be no more than $24k/year, but the new salary would more than double the difference. DW is encouraging me to pursue the new opportunity. Kids are young enough to not be too impacted.

So, if I worked this position 2 – 3 years, I feel I would be in a better mindset to go back to contracting work with even more in demand skills or semi-FIRE by returning to MN or somewhere warmer.

In addition, I have another FTE job in Minneapolis that I’m also interested in and completed the 2nd round of interviews. Staying in MN would be the easier choice, but the winters seem to get longer each year I’m here.

Honestly, I can’t imagine not working at this time, so I just want to have a challenging gig for a few more years. CA offers an opportunity to explore something new. What else should I be thinking about at this stage?

Basically, my family’s annual expenses range from $55-60k (no mortgage or car payments) and I netted $60k rental income after all expenses/vacancies. This is my part time job as I perform most property management and minor maintenance/repairs, but hiring out major repairs.

Besides rental properties, other assets: primary residence is paid in full, $1.2M in savings, taxable investments, and retirement funds along with a small annual pension of 13k, non-cola, at age 55 and SS in the future. Two college funds with a fair amount saved (total currently $80-90k), but will continue to fund for a few more years to a target of $150k, while letting the market work some magic the next 10 - 12 years. The international travel fund can always use more $$ as DW and I are young and interested in more travel in the future. No debt at this time.

Here is my personal dilemma; a variation to OMY is my OMJ syndrome…. OMJ = One More Job. While I’ve enjoyed the contract job, I felt bored and not really challenged. I have a new opportunity in an area of technology (SaaS using cloud computing) that I’m excited to learn. The downside is the job is located in Los Angeles, CA, a much higher cost of living area. By renting out our primary residence, out of pocket CA rent would be no more than $24k/year, but the new salary would more than double the difference. DW is encouraging me to pursue the new opportunity. Kids are young enough to not be too impacted.

So, if I worked this position 2 – 3 years, I feel I would be in a better mindset to go back to contracting work with even more in demand skills or semi-FIRE by returning to MN or somewhere warmer.

In addition, I have another FTE job in Minneapolis that I’m also interested in and completed the 2nd round of interviews. Staying in MN would be the easier choice, but the winters seem to get longer each year I’m here.

Honestly, I can’t imagine not working at this time, so I just want to have a challenging gig for a few more years. CA offers an opportunity to explore something new. What else should I be thinking about at this stage?

Last edited: