ER_Hopeful

Recycles dryer sheets

So my daughter sprained her ankle and her roommate took her to a local hospital emergency room. I think they took a few x-rays, wrapped her foot up, gave her a pair crutches and sent her home.

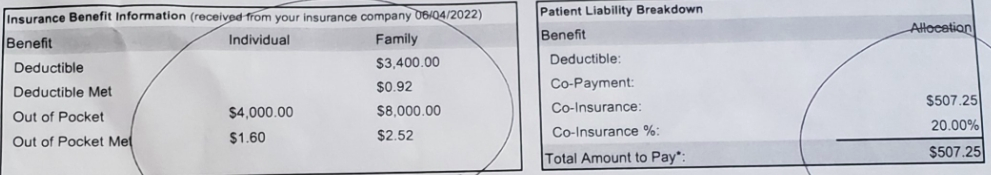

A few weeks later, she got billed for almost $3k . I have Anthem BlueCross thru my employer, it's a PPO with a $3k individual deductible. DD is a full time student and is covered under my plan. The bill has just a grant total without any details. She already called and asked for an itemized list of charges, should be coming in the mail. They gave her an estimate charge of $500 (see attached) before they admitted her on that day but $3k is far from that!

any course of action she can take (to lower the bill at least)? She has a part time job but makes very little and I'm supporting her thru college, so can they come after me?

A few weeks later, she got billed for almost $3k . I have Anthem BlueCross thru my employer, it's a PPO with a $3k individual deductible. DD is a full time student and is covered under my plan. The bill has just a grant total without any details. She already called and asked for an itemized list of charges, should be coming in the mail. They gave her an estimate charge of $500 (see attached) before they admitted her on that day but $3k is far from that!

any course of action she can take (to lower the bill at least)? She has a part time job but makes very little and I'm supporting her thru college, so can they come after me?