ImThinkin2019

Recycles dryer sheets

Learned about this in another thread. https://www.early-retirement.org/forums/f28/my-own-retirement-calculator-102178.html

Thought it deserved more visibility.

We bought this calculator recently to help us plan roth rollovers. In particular, we wanted the tax burden calculation. We were considering developing this ourselves but heard about Pralana.

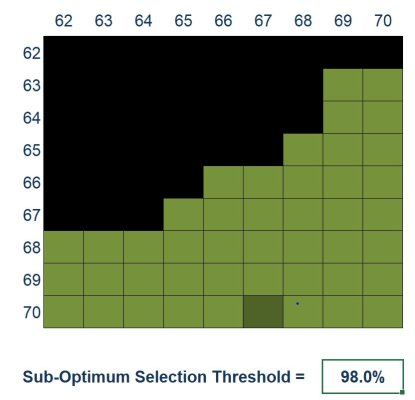

Pralana allows comparison of three different scenarios. For example, "no rollovers" vs "rollovers optimized to stay below a given tax bracket" to "rollovers spread over a given time period". It provides the output in both chart and spreadsheet format.

It also has built-in sensitivity calcualations to study various options like living longer, retiring earlier, higher yield, etc.

All of the calculations we might have wanted to develop ourselves are in there, at least from what we have seen so far.

It is also pretty flexible - one can adjust forecast spending or income and see the effect. For example, since we are investigating memory care and skilled nursing for DW's parents, we just modeled the effect of spending another $9K/month at the end of our lives. For us, this made a growing porfolio "get dented". Better for our heirs if we dont need it....

We have used a variety of calculators in the past - Vanguard, FIDO, i-orp, firecalc, homegrown, etc. This calculator is more complete and easier to use than those others. It's obvious that the developers spent many hours creating and refining it.

The only downfall we have seen is that this tool has no tracking capability. So we will need to do this on our own. We find it useful to compare "actual" vs "plan". (My boss is comparing actual vs plan at work and this may cause me to retire sooner rather than later .

.

Bottom line is that Pralana may be worth a look.

Thought it deserved more visibility.

We bought this calculator recently to help us plan roth rollovers. In particular, we wanted the tax burden calculation. We were considering developing this ourselves but heard about Pralana.

Pralana allows comparison of three different scenarios. For example, "no rollovers" vs "rollovers optimized to stay below a given tax bracket" to "rollovers spread over a given time period". It provides the output in both chart and spreadsheet format.

It also has built-in sensitivity calcualations to study various options like living longer, retiring earlier, higher yield, etc.

All of the calculations we might have wanted to develop ourselves are in there, at least from what we have seen so far.

It is also pretty flexible - one can adjust forecast spending or income and see the effect. For example, since we are investigating memory care and skilled nursing for DW's parents, we just modeled the effect of spending another $9K/month at the end of our lives. For us, this made a growing porfolio "get dented". Better for our heirs if we dont need it....

We have used a variety of calculators in the past - Vanguard, FIDO, i-orp, firecalc, homegrown, etc. This calculator is more complete and easier to use than those others. It's obvious that the developers spent many hours creating and refining it.

The only downfall we have seen is that this tool has no tracking capability. So we will need to do this on our own. We find it useful to compare "actual" vs "plan". (My boss is comparing actual vs plan at work and this may cause me to retire sooner rather than later

.

.Bottom line is that Pralana may be worth a look.

How long would our property keep us in said 'home' if we were both there and ran out of our investments?

How long would our property keep us in said 'home' if we were both there and ran out of our investments?