ERD50

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

...

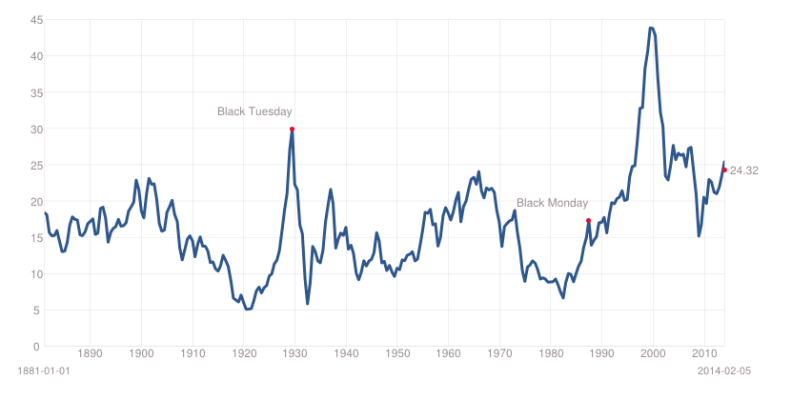

Where does the value of this simple model come? From avoiding the declines, and having lots of funds to invest at stock market bottoms. Look at 2009 you would be more than doubling your allocation to stocks based on this model. Data for the 1960's and 1970's will be interesting to see how this holds up.

Can you run the same data to show how a 60/40 or 75/25 with and w/o rebalancing would have compared? Or share your spreadsheet so we could take a shot at it with the same data?

Sometimes, the % declines are less because the run up was less.

edit/add: For example, your (simple, not weighted) average stock allocation during the raging bull of the 1990's was only 36.9%. That would have left an awful lot on the table compared to 75%.

-ERD50

Last edited: