Brett_Cameron

Thinks s/he gets paid by the post

9/14 12.6%

11/1 11.4%

11/15 8.4%

aa 60/40

11/1 11.4%

11/15 8.4%

aa 60/40

I just realized one thing. Do the numbers above also include the amount of money saved this year or just the interest on the total invested assets as of last January ?

The values presented here appear to be just great, taking into consideration that DowJones only made about 0,3% since January 1st!

Congratulations!

I just realized one thing. Do the numbers above also include the amount of money saved this year or just the interest on the total invested assets as of last January ?

Rustward said:You probably get a little of everything -- some making contributions, some taking distributions, some doing both, some giving true YTD numbers, some giving annualized YTD numbers, some that are not sure, but they see a number on Quicken or a brokerage display and just use that.

Us, we are up almost 10% after taking enough to pay some bills and not making contributions.

I shouldn't be posting here, because DW and I are ultra risk averse.

I just realized one thing. Do the numbers above also include the amount of money saved this year or just the interest on the total invested assets as of last January ?

I am pleased to read that I am not the only one to be totally risk averse around here.I shouldn't be posting here, because DW and I are ultra risk averse.

The OP asked for 'returns', which means gains/losses net of deposits/withdrawals. We can't know if some people reporting here have followed that definition, unless they specified......

According to TSP, my last 12 months return is (as of Oct. 31st) 27.52%. I don't know what it is from 1/1/12 to date. Also, haven't looked in a couple of weeks, but at last glance, Vanguard said wife's rollover IRA was around 8.5% or so, roughly the same for our Roth IRA's.

The OP asked for 'returns', which means gains/losses net of deposits/withdrawals. We can't know if some people reporting here have followed that definition, unless they specified.

Including deposits/withdrawals, the question should be "How has your net worth changed YTD?" - but that isn't a useful number if you are trying to compare investments, as the OP is.

You should be aware, there is a big difference in age between imoldernu(hint: imoldernu=I'm-Older-Than-You) and obgyn65. Many people would consider his AA to be appropriate for his age, but not for a younger person. Apples-oranges.

-ERD50

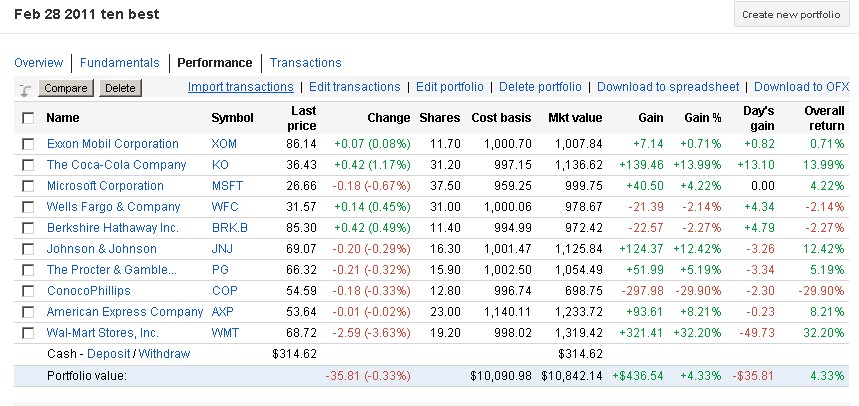

I always look at YTD return % of the total portfolio and compare it to S&P 500 index %. Should I annualize it? Is the S&P 500 index YTD % an annualized rate?In my case it is the internal rate of return on my investment portfolio given the beginning market value, cash flow (additions, withdrawals, interest, dividends, etc) and ending market value; then converted to an annualized rate. It is off the Investment Performance report in Quicken.