audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

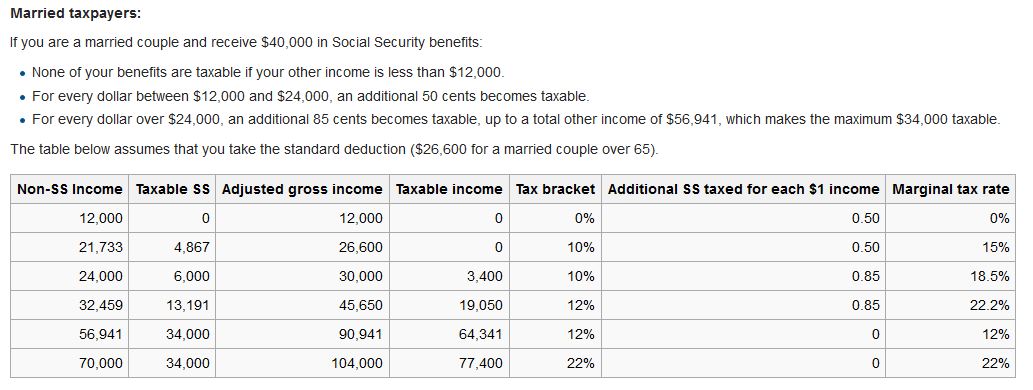

That is the RMD problem for many. They are forced to take out money they might not need, pay taxes they may otherwise not pay, including taxes on their Social Security they may have never had to pay before. And on top of that, because of draconian RMD IRS rules, many seniors may need to employ tax professionals for the first time. And as others here have posted, RMD might also cause their Medicare B premiums to increase.

It might be life as usual for you... but for others it could be quite a culture shock.

.

That was the deal they signed up for when they were allowed to tax defer that money on the first place. No one “forced” them to put that money in tax deferred savings vehicles, and yes, they don’t get to keep it all in there for the rest of their lives and pass it along tax free to heirs. That was the deal up front - loud and clear. You got to grow the money tax free for decades, come 70 its time to start paying the piper.

It would be much simpler tax wise to not save and invest, and just rely on social security.

Last edited:

How could this be? Who woulda thunk?

How could this be? Who woulda thunk?