Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

A few months ago I went through a deep dive and finally committed to Roth conversions (thread link below). Voluntarily paying taxes up front was always my primary barrier. And simple online Roth conversion calculators always came back close to a wash, so I didn't get serious. When I did...

There's WAY more to it than that, but I won't rehash it all here, it's in the prior thread in too much detail already.

I just finished my 2019 taxes which included my first large Roth conversion. I came up short of maxing out the 22% bracket in 2019, but that's the plan for the next 6-7 years. Without doing any conversions, we'd be in the 22% bracket from age 71 and every year until we go poof. With 22% conversions, we'll be in the 15% bracket from age 71 on. If tax rates stay the same, our residual portfolio won't change much good or bad, though we'll have inheritance/widower benefits. But if future tax rates increase as I believe, we'll come out (much) better.

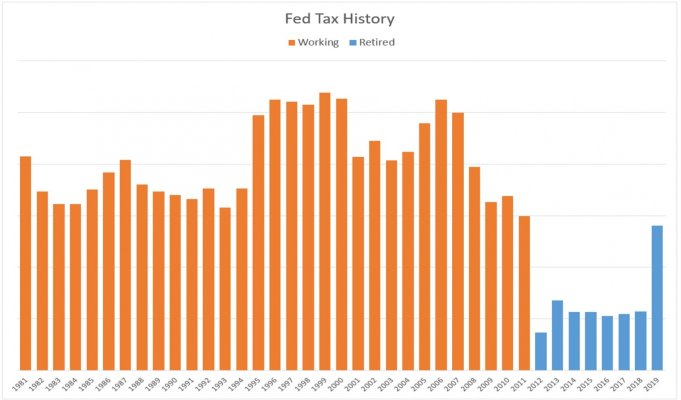

The bad news is, as expected, our effective income tax rate has tripled over what we paid 2012 thru 2018 - what (shortsightedly) always held me back.

The good news is when I did my annual update of my historical tax spreadsheet, I realized what a dope I've been. I'd FORGOTTEN what it was like to really pay taxes. Though my Roth conversions will be even higher in the next 6-7 years, my effective income tax rate will be about the same as 2019.

Our circumstances are all different, we all have to do our own deep dive. But for those in a similar situation, I thought this could be illuminating - don't be a dope like me.

Too soon old, too late smart...

https://www.early-retirement.org/forums/f28/retirement-tax-planning-income-optimization-99854.html

Chart below is effective federal tax rate % annually.

There's WAY more to it than that, but I won't rehash it all here, it's in the prior thread in too much detail already.

I just finished my 2019 taxes which included my first large Roth conversion. I came up short of maxing out the 22% bracket in 2019, but that's the plan for the next 6-7 years. Without doing any conversions, we'd be in the 22% bracket from age 71 and every year until we go poof. With 22% conversions, we'll be in the 15% bracket from age 71 on. If tax rates stay the same, our residual portfolio won't change much good or bad, though we'll have inheritance/widower benefits. But if future tax rates increase as I believe, we'll come out (much) better.

The bad news is, as expected, our effective income tax rate has tripled over what we paid 2012 thru 2018 - what (shortsightedly) always held me back.

The good news is when I did my annual update of my historical tax spreadsheet, I realized what a dope I've been. I'd FORGOTTEN what it was like to really pay taxes. Though my Roth conversions will be even higher in the next 6-7 years, my effective income tax rate will be about the same as 2019.

Our circumstances are all different, we all have to do our own deep dive. But for those in a similar situation, I thought this could be illuminating - don't be a dope like me.

Too soon old, too late smart...

https://www.early-retirement.org/forums/f28/retirement-tax-planning-income-optimization-99854.html

Chart below is effective federal tax rate % annually.

Attachments

Last edited: