OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I have always felt that Roth conversions were basically tax rate arbitrage with future tax rates unknown. IOW we win if the future tax rates are [-]lower[/-]higher, we don't-care if they are the same, and we [-]lose[/-]win if they are higher. My personal ability to predict the behavior of federal and state governments is poor, so I just sit on my hands.

Hence, I am puzzled by all the excitement for conversions that seems to exist here.

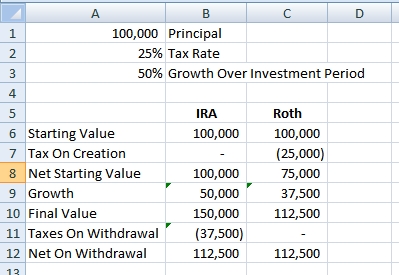

Here is a simple little example I just cooked up to reflect what has been in my head:

It seems that this may be best case because the $100K taken from an IRA may drive the taxpayer into higher income taxes on SS or lower ACA subsidy.

Am I missing something?

Hence, I am puzzled by all the excitement for conversions that seems to exist here.

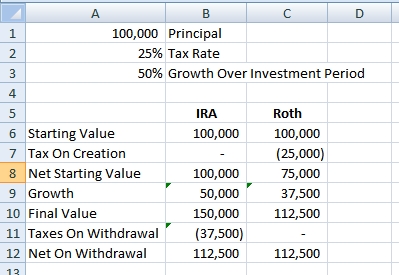

Here is a simple little example I just cooked up to reflect what has been in my head:

It seems that this may be best case because the $100K taken from an IRA may drive the taxpayer into higher income taxes on SS or lower ACA subsidy.

Am I missing something?

Last edited: