Independent

Thinks s/he gets paid by the post

- Joined

- Oct 28, 2006

- Messages

- 4,629

Start with "ease of collection and greater compliance." Do you find it easier to figure and pay your federal and state income taxes or your state sales tax? Which do you think offers more opportunity for tax evasion? Clearly the sales tax wins hands down in terms of "ease of collection and compliance."

As a general economic principal, we should look to tax things we want less of. An income tax taxes savings, investment, and work - all things we want more of if our objective is to foster economic growth.

Taxes on investment income generally tax delayed consumption more highly than current consumption because it treats inflationary gains as income. Meanwhile sales taxes tax consumption uniformly regardless of when it occurs.

Taxes on capital gains create frictions in investment decisions where people decide not to sell assets to avoid paying a tax. Imagine an owner of a junky store retaining ownership even though he doesn't want the store any longer and the property could be put to better use by someone else. Ideally we want a tax system that doesn't bias these kinds of economic decisions.

Same too with marginal income taxes. The decision to work an extra hour shouldn't be biased by changes in effective tax rates.

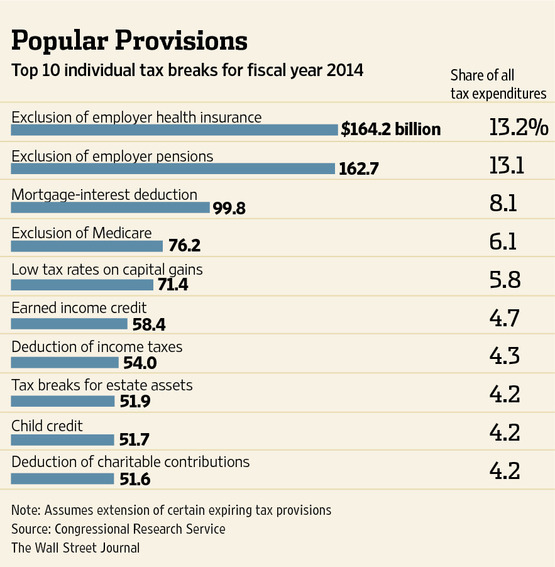

Our income tax, as currently configured, contains thousands of preferences, deductions and credits that not only distort economic decisions but also require thousands of manhours and even entire industries of wasted effort to comply. Income taxes, with their mandatory filing requirements, are more susceptible to these kinds of uneconomic policies - although progressive sales tax schemes could be made equally bad.

I'll take the other side of this, recognizing that neither of us has any say in tax policy anyway (at least I don't, I guess I'm not sure about you).

According to Slemrod, no nation has maintained a general retail sales tax above 10%. Compliance gets so bad that they have to switch to VAT. Now a VAT should be somewhat simpler than an income tax, but the gap isn't so large.

I don't "want" more saving/investing. The market provides incentives to get out of bed and work, and it provides incentives to save/invest. I don't think we should assume the market rates are "wrong" and need to be "corrected" by differential tax rates.

All taxes generate frictions, the one you mention isn't particularly bad. Both low marginal rates and minimal complexities are useful in reducing frictions. Both of those argue for taxing capital income at the same rate as labor income.

A good trade-off would be to index capital gains to inflation as part of the deal match the rates on labor income.

Not sure what "changes" in effective tax rates means. Note that for working people who consume all their incomes, taxing consumption is the same as taxing income.

Agreed. We should dramatically simplify the federal tax system. Note that some of those wasted hours are currently spent trying to re-label labor income as capital income to take advantage of the lower rate. That's another good reason to make them the same. And I'll agree that a VAT tax, left in the hands of lobbyists and politicians for a century, would be likely to have a remarkable level of complexity.