TromboneAl

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 30, 2006

- Messages

- 12,880

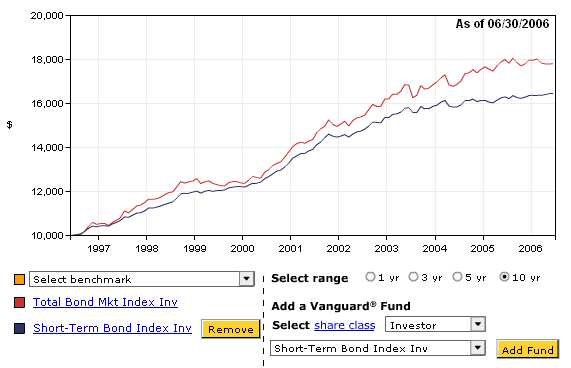

I'm mulling over a move from my VG short-term bond index fund (avg maturity 2.8 ) to VG Total Bond Index fund (avg maturity 7.3).

My reluctance to move away from short term is based on this, from fundadvice.com:

Whether your portfolio is heavy or light on bonds, it matters what kind of bonds you own. In general, longer bond maturities go together with higher yields and higher volatility. However, I’ve studied enough data to convince me that bonds with maturities greater than five years are not consistently more rewarding than shorter-term bonds. But they are consistently more risky.

In the 36 years under study here, the longest maturity you needed in order to achieve high bond returns was five years. All the data I have seen also indicates that one-year Treasury bills gave investors nearly 95 percent of the return of five-year Treasury notes, with much less volatility.

We believe the best combination of bond funds for stabilizing an equity portfolio – and that is why we include bonds in the Ultimate Buy-and-Hold Strategy – is a 50/50 split of bonds with maturities up to two years and those with maturities up to five years. You can find a close approximation of this mix in the typical short-term bond fund.

OTOH, in this comparison, over 10 years, the short term fund's return is only 82% as good as the total bond fund's return.

My reluctance to move away from short term is based on this, from fundadvice.com:

Whether your portfolio is heavy or light on bonds, it matters what kind of bonds you own. In general, longer bond maturities go together with higher yields and higher volatility. However, I’ve studied enough data to convince me that bonds with maturities greater than five years are not consistently more rewarding than shorter-term bonds. But they are consistently more risky.

In the 36 years under study here, the longest maturity you needed in order to achieve high bond returns was five years. All the data I have seen also indicates that one-year Treasury bills gave investors nearly 95 percent of the return of five-year Treasury notes, with much less volatility.

We believe the best combination of bond funds for stabilizing an equity portfolio – and that is why we include bonds in the Ultimate Buy-and-Hold Strategy – is a 50/50 split of bonds with maturities up to two years and those with maturities up to five years. You can find a close approximation of this mix in the typical short-term bond fund.

OTOH, in this comparison, over 10 years, the short term fund's return is only 82% as good as the total bond fund's return.