Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I came across this article in Humble Dollar. We endlessly debate the pros and cons of when to start taking SS. Here is another way to look at that decision for those who have the ability to finance their lifestyle without taking SS. Needless to say, it's an individual decision with no one right answer for everybody. I offer this as food for thought.

https://humbledollar.com/2021/09/in..._medium=email&utm_campaign=another-ses-test_7

The author uses as an example a person who delays a $1000 a month benefit for one year and ends up collecting $1080 a month. He also looks at the return of other inflation adjusted annuities on the market.

https://humbledollar.com/2021/09/in..._medium=email&utm_campaign=another-ses-test_7

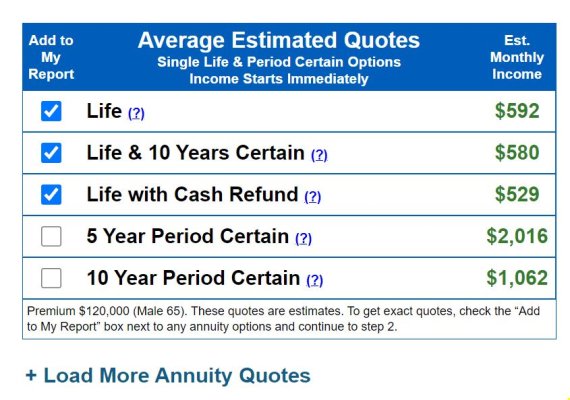

The author uses as an example a person who delays a $1000 a month benefit for one year and ends up collecting $1080 a month. He also looks at the return of other inflation adjusted annuities on the market.

https://crr.bc.edu/briefs/should-you-buy-an-annuity-from-social-security/The paper says you should think of it just that way: You bought a $960-a-year lifetime annuity from the SSA for $12,000. That’s an 8% return. Even better, that $960 a year will increase annually along with inflation. On top of that, if you’re married, you had the higher lifetime earnings and you predecease your spouse, your benefit will be paid to your husband or wife as a survivor benefit.

May 2012

The brief’s key findings are:

- Households now retiring need to transform their 401(k) and IRA savings into retirement income.

- One way is to delay claiming Social Security to increase their monthly benefit, using savings to pay current expenses while they wait.

- In effect, they are buying an annuity from Social Security: The savings used is the “price” and the increase in their monthly benefit the annuity income it “buys.”

- Buying an annuity from Social Security is generally the best deal in town, especially in today’s low interest-rate environment.

Last edited: