corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

There's nothing like a good illness to ease your mind off SORR.

And I am not talking about something like what residents of Wuhan are going through. They are worrying about something much more immediate than SORR.

Life can get exciting, even for people who do not look for trouble.

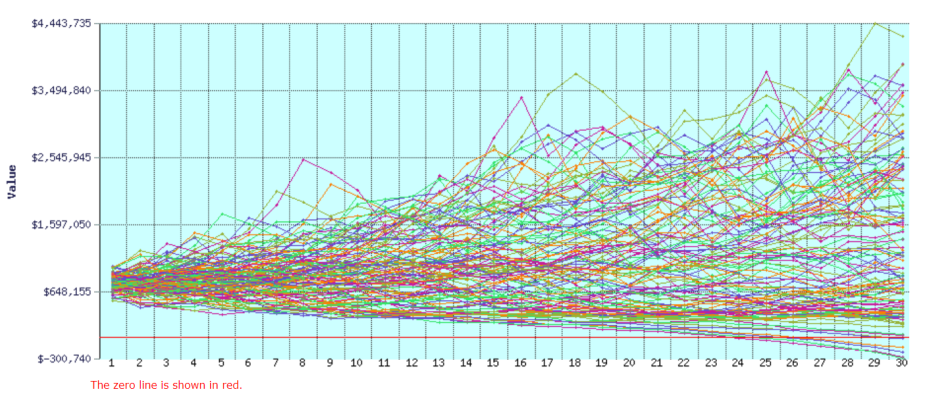

I hear ya. I got laryngitis on New Year's Day. Went to the doc and got antibiotics. Then steroids. After 4 weeks I went to the ENT. 30 minutes after I got there I was in the hospital getting CAT scans of my head, neck and lungs because he said I had a 50% chance of having lung cancer. Turns out it was not cancer (paralyzed left vocal cord, which still isn't good), but holy hell, that was a rough 24 hours. Did a lot of what if's in the retirement spreadsheet that night waiting for the results from the scan.