COcheesehead

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

i guess my hourly FA who suggested about 200k of inherited $$ into SHY about a month ago is entirely wrong by your forecast.

Here is the one month return on SHY

i guess my hourly FA who suggested about 200k of inherited $$ into SHY about a month ago is entirely wrong by your forecast.

Here is the one month return on SHY

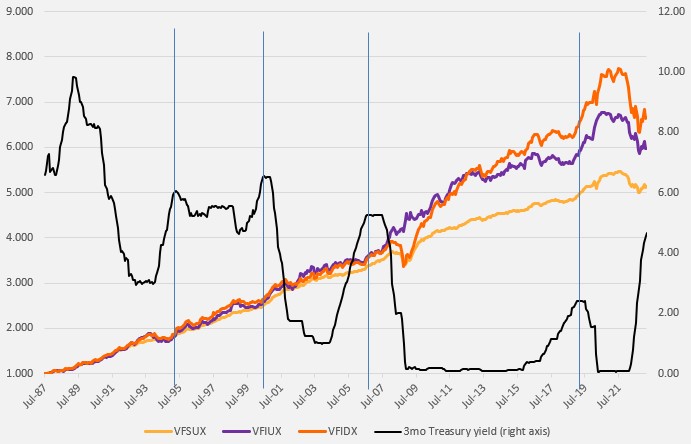

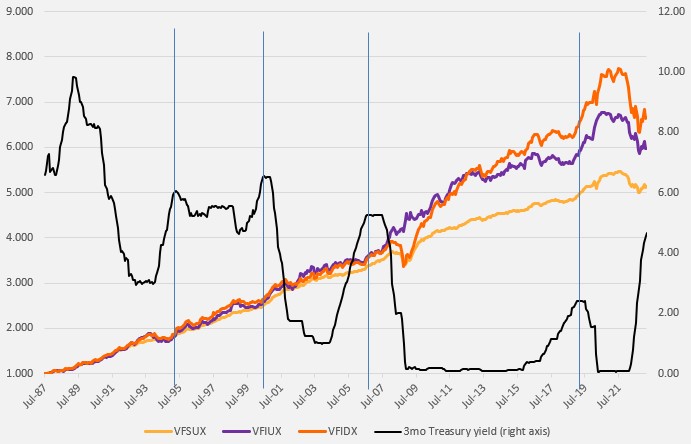

Here is a chart I made for my purposes. The 3 month Treasury is a proxy for the Fed Funds rate which move together. It shows that bond funds can really take off as soon as the 3 month Treasuries start to flatten or such a situation is recognized as a pause by the markets. Not easy to catch the initial upward thrust.

VFSUX = ST investment grade

VFIUX = intermediate Treasuries

VFIDX = intermediate investment grade

You asked if your financial person’s recommendation regarding SHY 30 days ago was wrong. It lost you money in that time frame. If rates continue upward as we are told they likely will, you will continue to lose money.So...if you are in the market for longer than a one month period...and looking 1, 3 or 5 years out...still a bad choice?

I prefer holding bond funds and have owned them since late 90s. I don’t move in and out of asset classes in anticipation of markets trends - that’s just not my investing style.I can't be the only one here who is holding ST bond funds. If one has experienced the NAV losses of 2022 and has continued to hold, isn't one foolish to exit such positions when in fact, one hasn't technically "lost" until one 'sells' - and, ones returns - in the form of the dividends that are improving in tandem with rising interest rates - are improving. Am I extraordinarily missing something?

I can't be the only one here who is holding ST bond funds. If one has experienced the NAV losses of 2022 and has continued to hold, isn't one foolish to exit such positions when in fact, one hasn't technically "lost" until one 'sells' - and, ones returns - in the form of the dividends that are improving in tandem with rising interest rates - are improving. Am I extraordinarily missing something ?

You can roll 3-9 month treasuries right now, make 5%+ and not lose a dime in principle.

Ok BUT... when you cite performance, are you also factoring in the fund's dividend and return, i.e., income, not just NAV?

I don’t see a repeat in 2023 of the nav downturns to the same extent. That is not to suggest that bond funds (or individual bonds) are worthy investments at present. Certainly, largely depends upon the objectives of the investor.

\\

...

SS will be in the realm of 21k/yr whenever i choose to take it... Medicare kicks in this year. All that said, is having a portion of my 50% FI in ST Bond funds 'dangerous' at this stage, given the above circumstances and 'time horizon' ? (Loaded answer I guess LOL)

All that said, is having a portion of my 50% FI in ST Bond funds 'dangerous' at this stage, given the above circumstances and 'time horizon' ? (Loaded answer I guess LOL)

I can't be the only one here who is holding ST bond funds. If one has experienced the NAV losses of 2022 and has continued to hold, isn't one foolish to exit such positions when in fact, one hasn't technically "lost" until one 'sells' - and, ones returns - in the form of the dividends that are improving in tandem with rising interest rates - are improving. Am I extraordinarily missing something ?

I can't be the only one here who is holding ST bond funds. If one has experienced the NAV losses of 2022 and has continued to hold, isn't one foolish to exit such positions when in fact, one hasn't technically "lost" until one 'sells' - and, ones returns - in the form of the dividends that are improving in tandem with rising interest rates - are improving. Am I extraordinarily missing something ?

| Type | $/Share | Payable date | Record date | Reinvest date | Reinvest price | Distribution yield |

| Dividend | $0.015323 | 03/01/2023 | 02/28/2023 | 02/28/2023 | $9.84 | 2.02% |

| Dividend | $0.016319 | 02/01/2023 | 01/31/2023 | 01/31/2023 | $9.98 | 1.93% |

| Dividend | $0.015614 | 01/03/2023 | 12/30/2022 | 12/30/2022 | $9.87 | 1.86% |

| Dividend | $0.014496 | 12/01/2022 | 11/30/2022 | 11/30/2022 | $9.89 | 1.80% |

| 10 - 12 months | 2 years | 3 years | 4 years | 5 years |

| 5.35% | 5.30% | 5.40% | 5.20% | 5.40% |

...

What would you rather have 2.02% rising to 2.3% or 5.33%? Plus with the ladder if rates rise further while the value of both VBIRX and the ladder will decline with the ladder you can chose to hold the CDs to maturity, not an option available to the bond fund holder.

Frankly I am not sure how to make this comparison. But the SEC yield for VBIRX is 4.75%. The distribution yield is, I believe, just due to the older bonds having a lower yield. Their price has adjusted to be competitive with current bonds. If distribution yield is your criteria then that is important. But I just look for total return which is a combination of price change + distribution yield.

If you look at the fund's financial statements, then you'll see that the distributions track very closely with interest income. Pick 5 different bond funds and compare the portfolio average coupon with the distribution yield over recent monthsand you will see the same pattern.

So to make the comparison easier, let's say that in 2023 there are no changes in interest rates... the fund will collect the coupons and then distribute it to the fundholders and there would be no change in unrealized gains or losses so the return would be solely the distributions.

Prevailing market interest rates change after a bond is issued, and bond prices must adjust to compensate investors. If interest rates rise, then bond prices must fall. Suppose a three-year bond pays 3% when it is issued, and then market interest rates rise by half a percentage point a year later.

To sell the bond in the secondary market, the price of the bond will have to fall about 1% (extra 0.5% per year x 2 years), so it will be trading at a discount to face value. New bonds issued from firms with similar credit quality are now paying 3.5%. The old 3% bond still pays 3% in interest, but investors can now look forward to an extra 1% when the bond matures. Similarly, the price of the bond must rise if interest rates fall.

SEC yield

A non-money market fund's SEC yield is based on a formula developed by the SEC. The method calculates a fund's hypothetical annualized income as a percentage of its assets.

A security's income, for the purposes of this calculation, is based on the current market yield to maturity (for bonds) or projected dividend yield (for stocks) of the fund's holdings over a trailing 30-day period. This hypothetical income will differ (at times, significantly) from the fund's actual experience. As a result, income distributions from the fund may be higher or lower than implied by the SEC yield.