You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Subject: Best healthcare strategy for FIRE at 63+

- Thread starter horfield

- Start date

horfield

Dryer sheet wannabe

Yes, but given his work status change, I think he has a bit longer? If work ended on 12/5, I think he has a "change of life" status claim that might buy him some time.

As far as Cobra v the ACA, one factor I missed - is OP a big consumer of HC today? Do you have favorite docs/specialists you want to stay with? Cobra may offer more options there, as you literally continue your workplace plan in most cases. Staying on Cobra for up to 18 months would make for an easy slide into Medicare with just a few months to cover on the ACA, costs aside.

you also received a severance? If that was lump sum, fine, of not, if it's serial, that would be 2023 income. But I'm guessing lump given the rest of the details.

Again thanks everyone for helping me get informed!

Yes, I received a lump sum severance so it is all in this tax year. I am covered under my work insurance until December 31st so it's a fairly clean break.

To answer your question above, We are not big consumers of HC. I just had one annual physical this year and two regular prescriptions. That's it. My wife needs some specific medications but also just one annual physical and one routine visit to a specialist doctor (who is out of state) this year. May need to find a new one. No hospital visits or anything like that.

The silver plans at 70% coverage look like the best deal for our circumstances but having established the principle of going the ACA route, I need to sort through all the available plans. There is a Blue Cross/Shield PPO that looks promising. As our current primary care physician takes that company I need to check they would their ACA plans.

It would be useful if there was some kind of comparison site where I could put in my former employer's (Blue Cross/Shield) plan and have it compared to the best equivalent ACA plan for my state. (AZ) Looks like the process is a lot of research though.

Last edited:

walkinwood

Thinks s/he gets paid by the post

A couple of other points to mull over in the next year

- The $25K or so that you need to show is in addition to the Standard Deduction.

- Look at an HSA plan which can allow you to deduct another ~9K from your income. HSAs are a great deal. Read about it if you haven't. Fidelity offers a $0 cost HSA account.

- We use a Bronze plan and feel we come out ahead because we don't use much health care.

- Maximizing subsidies may not be the best strategy. In the long run, you may be better served with ROTH transfers or realizing cap gains in the 0% bracket. You have a whole year to figure out the optimum strategy.

The most important thing is to select a plan on your state exchange before 12/15 so that you have continuous coverage starting 1/1/23

- The $25K or so that you need to show is in addition to the Standard Deduction.

- Look at an HSA plan which can allow you to deduct another ~9K from your income. HSAs are a great deal. Read about it if you haven't. Fidelity offers a $0 cost HSA account.

- We use a Bronze plan and feel we come out ahead because we don't use much health care.

- Maximizing subsidies may not be the best strategy. In the long run, you may be better served with ROTH transfers or realizing cap gains in the 0% bracket. You have a whole year to figure out the optimum strategy.

The most important thing is to select a plan on your state exchange before 12/15 so that you have continuous coverage starting 1/1/23

Last edited:

- Joined

- Apr 14, 2006

- Messages

- 23,104

A couple of other points to mull over in the next year

- The $25K or so that you need to show is in addition to the Standard Deduction.

-...

Are you sure about that? My impression is that the minimum income requirement is MAGI, which is income before taking the standard deduction. This website seems to agree with that understanding.

https://www.healthinsurance.org/glossary/modified-adjusted-gross-income-magi/

aaronc879

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jan 10, 2006

- Messages

- 5,351

Are you sure about that? My impression is that the minimum income requirement is MAGI, which is income before taking the standard deduction. This website seems to agree with that understanding.

https://www.healthinsurance.org/glossary/modified-adjusted-gross-income-magi/

Yeah, he was wrong on that one. Thanks for providing the link to verify.

RetiredAndLovingIt

Thinks s/he gets paid by the post

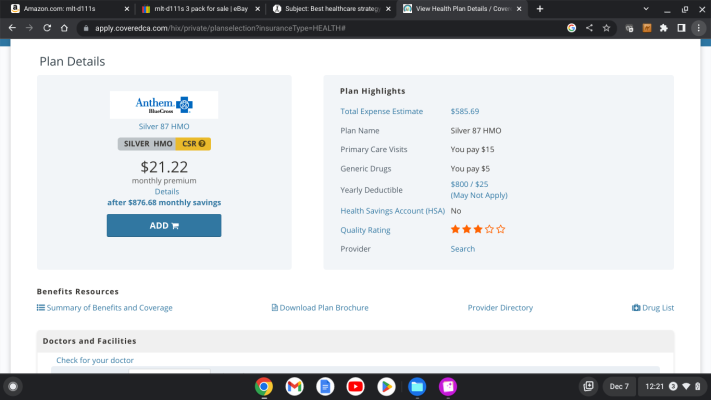

When I moved from my company Anthem Blue Cross plan to the ACA plan a few years ago, I just pulled and compared my current plan Summary of Benefits to the ACA plans that I was considering. The information you need should be under Plan Details and you can look up doctors, benefits, copays drug list etc, just keep scrolling down to view coverage or download the Plan Summary. In my case the ACA Anthem Silver PPO plan was identical to my company PPO plan at that time, See my sample screenshot from the covered california website, I assume your Arizona website will have all the information and links that you need to compare.

Attachments

ncbill

Thinks s/he gets paid by the post

The 10% penalty hurts though and my state charges a penalty of 33% of the federal penalty so 13.333% penalty overall. I hope to not have to do that very often.

So just convert to your Roth instead of taking an early distribution.

aaronc879

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jan 10, 2006

- Messages

- 5,351

So just convert to your Roth instead of taking an early distribution.

I will do that if I can but not everyone has the cash on hand to do that. I didn't feel confident letting my cash get so low by doing the conversion this year but I hope to do it next year if I need to get additional income. It will be a year-to-year decision based on my cash level.

- Joined

- Oct 13, 2010

- Messages

- 10,763

If you don't have cash on hand to pay the taxes, there's a way to address that. Say your income target indicates pulling $50K from pre tax accounts. You tinker with the split 45K + 5K, etc until you get to a split that if you convert the first amount, the second amount is the extra cash you need to cover the taxes. Then you do two transactions, the big one is the conversion, and the smaller one is for taxes. And to make it really easy, just apply the whole amount to withholding, essentially cutting a check to the IRS directly out of your pre-tax account.I will do that if I can but not everyone has the cash on hand to do that. I didn't feel confident letting my cash get so low by doing the conversion this year but I hope to do it next year if I need to get additional income. It will be a year-to-year decision based on my cash level.

aaronc879

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jan 10, 2006

- Messages

- 5,351

If you don't have cash on hand to pay the taxes, there's a way to address that. Say your income target indicates pulling $50K from pre tax accounts. You tinker with the split 45K + 5K, etc until you get to a split that if you convert the first amount, the second amount is the extra cash you need to cover the taxes. Then you do two transactions, the big one is the conversion, and the smaller one is for taxes. And to make it really easy, just apply the whole amount to withholding, essentially cutting a check to the IRS directly out of your pre-tax account.

I would only be taking money out of my IRA if I needed it go get my MAGI up to 100% FPL. If I don't make enough money to get to FPL then I need the money not only to qualify for ACA subsidies but also to live on. I live very cheap but even I have a hard time living on $13K/yr. I don't have the income or the net worth that everyone else here has so I can understand that it would be hard for you to relate.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I don't know why you all are bending over backwards to avoid Medicaid, it is the best coverage you can get and it is free. I literally can't be billed in my state.

For starters, the number of doctors who take Medicaid patients is often very limited. One of my young friends was on it for a while. She needed a specialist and the only one she could find who took Medicaid was a young guy with a new practice 30+ miles from her home. Not so good.

YMMV. All the docs and specialists are in my Managed Care plan so I see no difference in quality.For starters, the number of doctors who take Medicaid patients is often very limited. One of my young friends was on it for a while. She needed a specialist and the only one she could find who took Medicaid was a young guy with a new practice 30+ miles from her home. Not so good.

- Joined

- Nov 17, 2015

- Messages

- 13,979

For starters, the number of doctors who take Medicaid patients is often very limited. One of my young friends was on it for a while. She needed a specialist and the only one she could find who took Medicaid was a young guy with a new practice 30+ miles from her home. Not so good.

I think this varies wildly from plan to plan anyway. Almost off of us get some surprises coming off employer insurance and going to an ACA plan. Or switching medicare plans. Also varies a lot on location, down the the county.

I would imagine in Medicaid-expansion states it has a better uptake than not.

The lesson for anyone considering any plan (medicare/caid/cobra/aca, etc.) is to first take advantage of the search tools to find out who takes what, and then decide where and if to compromise. This is why shopping purely by price is often a false economy.

- Joined

- Oct 13, 2010

- Messages

- 10,763

You had indicated that you were contemplating a conversion, and I wasn't aware of the magnitude. If your pre-tax assets aren't that big, then a conversion is probably not going to be helpful; conversions help reduce the RMD 'tax torpedo' and that's probably less of an issue with lower pre-tax balances.I would only be taking money out of my IRA if I needed it go get my MAGI up to 100% FPL. If I don't make enough money to get to FPL then I need the money not only to qualify for ACA subsidies but also to live on. I live very cheap but even I have a hard time living on $13K/yr. I don't have the income or the net worth that everyone else here has so I can understand that it would be hard for you to relate.

Somewhat similar position as OP. Planning on retirement 5/1/23 and we are 62. I plan to keep Cobra for the 18 months, then do ACA or short term for the 8-10 month gap to Medicare. The reason I'm staying away from ACA is because of the ACA in GA. Our options and plans are terrible. All HMO's with no PPO's available and a very limited network of physicians. Plus we have some extended travel planned for the remainder of 2023. So, is Cobra cheap, no not at all but I feel it's the best option given what's available in GA.

If anyone know's better or has experience with ACA in GA, I'm open to suggestions.

If anyone know's better or has experience with ACA in GA, I'm open to suggestions.

Somewhat similar position as OP. Planning on retirement 5/1/23 and we are 62. I plan to keep Cobra for the 18 months, then do ACA or short term for the 8-10 month gap to Medicare. The reason I'm staying away from ACA is because of the ACA in GA. Our options and plans are terrible. All HMO's with no PPO's available and a very limited network of physicians. Plus we have some extended travel planned for the remainder of 2023. So, is Cobra cheap, no not at all but I feel it's the best option given what's available in GA.

If anyone know's better or has experience with ACA in GA, I'm open to suggestions.

Same in Texas. All HMOs.

horfield

Dryer sheet wannabe

Update from OP. Thank you everyone for the excellent advice and comments.

I set up a Silver PPO yesterday on (Arizona) Healthcare.gov based on a 2023 income of $36,000 which came out at only $577/month for myself and my wife and covers our existing doctors and medications. On that income, the deductible at $1,150 and out-of-pocket max at $2,500 worked out fairly well. Therefore by only generating $36,000 in income which I can draw from ROTH conversions, maybe some from investments etc, and I already have my substantial severance, means I am good for the whole of 2023 now.

My head is about to explode from all the research but given that my COBRA was going to cost $2,083/month for two people and the new plan is comparable and even better in some aspects, I am feeling quite good!

AZ had a range of HMO and PPO plans. The 5 Silver and Gold PPO's on offer were all Blue Shield/Cross, but as that is my existing (about to expire) company insurance and our doctors already take it, it works out well.

I set up a Silver PPO yesterday on (Arizona) Healthcare.gov based on a 2023 income of $36,000 which came out at only $577/month for myself and my wife and covers our existing doctors and medications. On that income, the deductible at $1,150 and out-of-pocket max at $2,500 worked out fairly well. Therefore by only generating $36,000 in income which I can draw from ROTH conversions, maybe some from investments etc, and I already have my substantial severance, means I am good for the whole of 2023 now.

My head is about to explode from all the research but given that my COBRA was going to cost $2,083/month for two people and the new plan is comparable and even better in some aspects, I am feeling quite good!

AZ had a range of HMO and PPO plans. The 5 Silver and Gold PPO's on offer were all Blue Shield/Cross, but as that is my existing (about to expire) company insurance and our doctors already take it, it works out well.

Last edited:

As for ACA and Healthcare, I don’t make the rules I just follow them.

I am in a similar financial position as you.... 1 million in real estate another couple million in accounts. Was downsized at 57, eight months before I earned retiree healthcare benefits. I am positive my short time to vesting put a target on my back for my employer.

Anyway, by managing our income we have had an ACA Bronze plan in Oregon for practically free for the last three years. It’s crazy that the government pays my health insurance premium. Given my assets I can afford it but, why would I pay when I can get it for free....completely legal.

What a waste of government assets. Solace is I did pay a lot of taxes in the past.

To accommodate this I’ve sold real estate, refinanced real estate, withdrawn from Roth and just worked it out.

I am in a similar financial position as you.... 1 million in real estate another couple million in accounts. Was downsized at 57, eight months before I earned retiree healthcare benefits. I am positive my short time to vesting put a target on my back for my employer.

Anyway, by managing our income we have had an ACA Bronze plan in Oregon for practically free for the last three years. It’s crazy that the government pays my health insurance premium. Given my assets I can afford it but, why would I pay when I can get it for free....completely legal.

What a waste of government assets. Solace is I did pay a lot of taxes in the past.

To accommodate this I’ve sold real estate, refinanced real estate, withdrawn from Roth and just worked it out.

The healthcare system is so screwed up. We live in Texas and as the other poster indicated, the ACA plans are terrible, HMO's only with very narrow networks. Being older, we need specialists for certain health issues and now we are pretty much screwed. Wife has gone back to work to at least have decent healthcare, even though we have plenty of assets and don't need the working income. Just need healthcare. Ridiculous.

The healthcare system is so screwed up. We live in Texas and as the other poster indicated, the ACA plans are terrible, HMO's only with very narrow networks. Being older, we need specialists for certain health issues and now we are pretty much screwed. Wife has gone back to work to at least have decent healthcare, even though we have plenty of assets and don't need the working income. Just need healthcare. Ridiculous.

Since we have such bad options, I'll either stick with Cobra as I've said, or do the ACA HMO with the crappy networks. Then we'll just self insure and pay out of pocket for our current providers out of network and use the ACA policy as a major medical type policy for something catastrophic. We'll have about 26 months of need to Medicare.

Has anyone else taken this approach with ACA HMO's.

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Wife has gone back to work to at least have decent healthcare, even though we have plenty of assets and don't need the working income. Just need healthcare. Ridiculous.

Since you're well off financially, why not just pay for the health insurance you want for the years until you qualify for Medicare? Or just pay out-of-pocket for out-of-network specialists your ACA plan doesn't cover?

Last edited:

youbet

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Since we have such bad options, I'll either stick with Cobra as I've said, or do the ACA HMO with the crappy networks. Then we'll just self insure and pay out of pocket for our current providers out of network and use the ACA policy as a major medical type policy for something catastrophic. We'll have about 26 months of need to Medicare.

Has anyone else taken this approach with ACA HMO's.

While I haven't taken this approach personally (had MegaCorp retiree coverage until Medicare), it sure makes sense. I'm often flabbergasted when I hear about folks with resources settling for less-than-optimum medical care because it just burns them to pay for it, even though they can afford it.

We are in Georgia and took the approach talked about by GATime. We did COBRA as long as we could and then switched to the ACA HMOs. We paid out of pocket for our long time care providers when necessary(sometimes they were in-network). We did find that the cash prices for our providers was often better than the HMO negotiated price, i.e. the cash price one year was less than the negotiated price from the previous years in-network HMO.

We looked at the ACA policy as bankruptcy insurance

We are now enjoying Medicare!

We looked at the ACA policy as bankruptcy insurance

We are now enjoying Medicare!

Similar threads

- Replies

- 11

- Views

- 378

- Replies

- 10

- Views

- 783

- Replies

- 16

- Views

- 1K

Latest posts

-

-

In Your City - What Are The Most Desirable Neighborhoods and Why?

- Latest: ShokWaveRider

-

-

-

-

-

-

-