A few years back, when we were in the midst of that “credit crisis” thing, a friend called in an absolute panic. She had just retired and was watching 40% of her equity disappear. I said “we’ve seen this before and it will come back.. don’t panic!” Naturally I suspect she sold and converted her paper losses to real losses. I dont know because we haven’t chatted since.

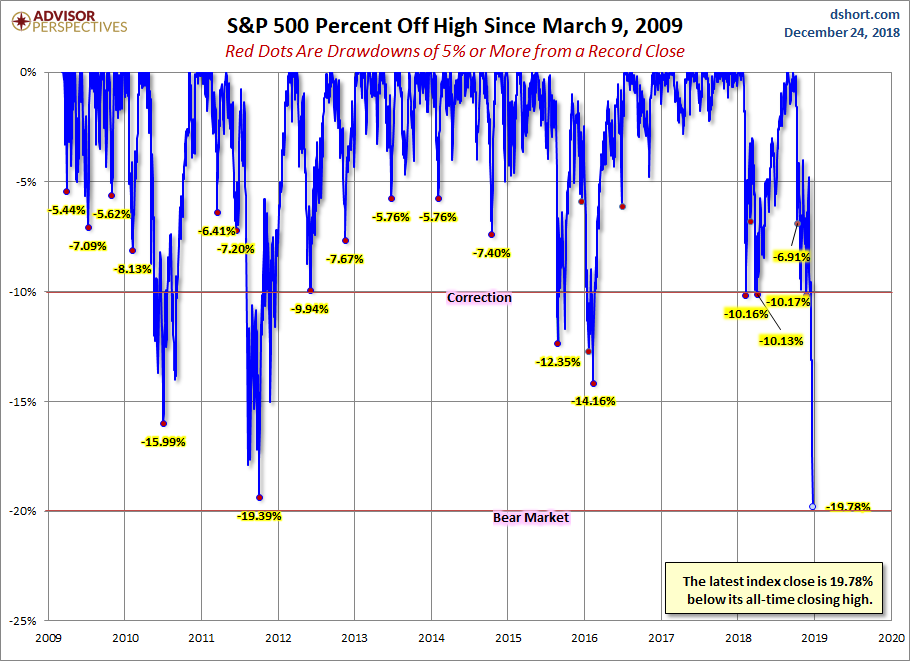

In September I let my instincts get the better of me and I converted all my 401K holdings to bond funds. Even thought I apparently averted a 20% loss I am unhappy with myself. Buy and hold means buy and hold. In fact I was going to either ask the ER gang when to get back in or simply just buy back in- its all a guess. Then this morning I see CNBC analyst essentially says: “You ain’t seen nothing yet”.. How he feels comfortable making this prediction Im not sure because in reality no one knows. What we do know: The insanity in DC continues and well Im just not having a warm and fuzzy feeling. I know Gutt investing is bad investing - call me human.

My 401K on 1/4/2019 will enter a kind of limbo. It takes a couple weeks after you retire before your request to roll it to gets completed. The Schwab 401k rollover account application is in an email ready for me to complete and submit. I think I’ll wait for the transfer to then to get back in.

More importly I had a great Christmas Eve meal, church service was kid centered, fun and the terrific bell performance got an applause that I could see made the older performer’s day. Guess what else? It isn’t particularly cold here! If the old pooch hadn’t scratched at 4:00AM things would be perfect.

I cant wait to get back in, never again... what can I say “Regrets I’ve had a few...” LOL

In September I let my instincts get the better of me and I converted all my 401K holdings to bond funds. Even thought I apparently averted a 20% loss I am unhappy with myself. Buy and hold means buy and hold. In fact I was going to either ask the ER gang when to get back in or simply just buy back in- its all a guess. Then this morning I see CNBC analyst essentially says: “You ain’t seen nothing yet”.. How he feels comfortable making this prediction Im not sure because in reality no one knows. What we do know: The insanity in DC continues and well Im just not having a warm and fuzzy feeling. I know Gutt investing is bad investing - call me human.

My 401K on 1/4/2019 will enter a kind of limbo. It takes a couple weeks after you retire before your request to roll it to gets completed. The Schwab 401k rollover account application is in an email ready for me to complete and submit. I think I’ll wait for the transfer to then to get back in.

More importly I had a great Christmas Eve meal, church service was kid centered, fun and the terrific bell performance got an applause that I could see made the older performer’s day. Guess what else? It isn’t particularly cold here! If the old pooch hadn’t scratched at 4:00AM things would be perfect.

I cant wait to get back in, never again... what can I say “Regrets I’ve had a few...” LOL

Last edited: