You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Treasury Bills, Notes, and Bonds Discussion 2024+

- Thread starter audreyh1

- Start date

aja8888

Moderator Emeritus

T Bills are starting to look good again now that SWVXX (SchwaB MM fund) is yielding 5.04%.

PaunchyPirate

Thinks s/he gets paid by the post

I’m buying into a one year t-bill in Tuesday’s auction. I’m hoping for a slight uptick in rate. But will be happy with recent rates as well.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Audrey, thanks for taking your valuable time to post these results every week.

Much appreciated..

You’re welcome. It’s quite easy and fast to do as long as I remember.

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Ha ha first and maybe only for the ER forum.Audrey,

Your sharing on this thread has been very helpful. I probably would not have started with T-Bills without this thread.

It was also nice to see your picture next to the cyber truck in the other thread.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I’m buying into a one year t-bill in Tuesday’s auction. I’m hoping for a slight uptick in rate. But will be happy with recent rates as well.

It’s seems pretty entrenched above 5% over the past week so you might get lucky

That is incorrect. SWVXX is still yielding 5.19%:T Bills are starting to look good again now that SWVXX (SchwaB MM fund) is yielding 5.04%.

https://www.schwabassetmanagement.com/products/swvxx

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I decided to join you for tomorrow’s 52 week auction.I’m buying into a one year t-bill in Tuesday’s auction. I’m hoping for a slight uptick in rate. But will be happy with recent rates as well.

Last edited:

aja8888

Moderator Emeritus

That is incorrect. SWVXX is still yielding 5.19%:

https://www.schwabassetmanagement.com/products/swvxx

Hmmm, I wonder what I was looking at when I saw the lower yield? Thanks!

The article linked below did not feel like a financial article simply written to boost advertising. It addresses the Canadian government approach for changing their bond purchasing/selling approach. The articles message is Canada is taking some risks.

“ The Government of Canada (GoC) has begun buying billions in Canada Mortgage Bonds (CMBs), in a last ditch effort to stimulate more borrowing. The planned purchases are equivalent to three-quarters of the cash the Federal government is forecast to borrow this year. ”. Here is the link to the article https://betterdwelling.com/canada-is-spending-75-of-its-forecast-deficit-to-prop-up-mortgages/

I am holding some Canadian bank bonds, most maturing within 5 years. I am wondering if this change in strategy by the Canadian government should raise our concerns about holding these bonds/buying more or is it mostly a non-issue for current/future Canadian bank bond holders?

“ The Government of Canada (GoC) has begun buying billions in Canada Mortgage Bonds (CMBs), in a last ditch effort to stimulate more borrowing. The planned purchases are equivalent to three-quarters of the cash the Federal government is forecast to borrow this year. ”. Here is the link to the article https://betterdwelling.com/canada-is-spending-75-of-its-forecast-deficit-to-prop-up-mortgages/

I am holding some Canadian bank bonds, most maturing within 5 years. I am wondering if this change in strategy by the Canadian government should raise our concerns about holding these bonds/buying more or is it mostly a non-issue for current/future Canadian bank bond holders?

pb4uski

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Nah, $30b Cdn a year isn't enough in to be a concern to me, but I agree that what they are doing doesn't make a lot of sense.

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I’m buying into a one year t-bill in Tuesday’s auction. I’m hoping for a slight uptick in rate. But will be happy with recent rates as well.

It’s seems pretty entrenched above 5% over the past week so you might get lucky.

The way this was trading on secondary the few days before and day of auction I was hoping for more like 5.08-5.1%, but still I’ll take 5.062%, much better compared to 4 and 8 weeks ago. My other 52-week bought last October I managed to catch 5.488% but that’s already 5 months old.

Last edited:

copyright1997reloaded

Thinks s/he gets paid by the post

I decided to join you for tomorrow’s 52 week auction.

As did I, first time in a few months.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This week's T-Bill auction results:

The 52-week T-bill had crept above 5% for a brief period over the past week or so in secondary trading, but already dropped below again as of today. It only auctions every 4 weeks.

| Bills | CMB | CUSIP | Issue Date | High Rate | Investment Rate | Price per $100 |

| 4-Week | No | 912797JP3 | 03/26/2024 | 5.270% | 5.365% | $99.590111 |

| 8-Week | No | 912797JX6 | 03/26/2024 | 5.270% | 5.387% | $99.180222 |

| 13-Week | No | 912796ZW2 | 03/21/2024 | 5.245% | 5.389% | $98.674181 |

| 17-Week | No | 912797KQ9 | 03/26/2024 | 5.215% | 5.380% | $98.276153 |

| 26-Week | No | 912797KL0 | 03/21/2024 | 5.130% | 5.340% | $97.406500 |

| 52-Week | No | 912797KJ5 | 03/21/2024 | 4.810% | 5.062% | $95.136556 |

The 52-week T-bill had crept above 5% for a brief period over the past week or so in secondary trading, but already dropped below again as of today. It only auctions every 4 weeks.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This weeks T-bill auction results:

Treasury Notes for March (plus April 1 since I forgot last week)

Oops - looks like I forgot last week. Things have been pretty hectic recently. I've got some travel coming up off and on so my postings will probably continue to be sporadic.

In the meantime you can check for auction results here. I usually look Thursday afternoon or Friday as all the auctions for the week complete by then.

https://www.treasurydirect.gov/auctions/upcoming/ then click on the "Auction Results" tab.

| Bills | CMB | CUSIP | Issue Date | High Rate | Investment Rate | Price per $100 |

| 4-Week | No | 912797JV0 | 04/09/2024 | 5.265% | 5.360% | $99.590500 |

| 8-Week | No | 912797JZ1 | 04/09/2024 | 5.260% | 5.377% | $99.181778 |

| 13-Week | No | 912796Y52 | 04/04/2024 | 5.230% | 5.374% | $98.663444 |

| 17-Week | No | 912797KW6 | 04/09/2024 | 5.200% | 5.364% | $98.281111 |

| 26-Week | No | 912797GW1 | 04/04/2024 | 5.125% | 5.334% | $97.409028 |

Treasury Notes for March (plus April 1 since I forgot last week)

| Notes | Reopening | CUSIP | Issue Date | High Yield | Interest Rate | Price per $100 |

| 2-Year | No | 91282CKH3 | 04/01/2024 | 4.595% | 4.500% | $99.820388 |

| 3-Year | No | 91282CKE0 | 03/15/2024 | 4.256% | 4.250% | $99.983268 |

| 5-Year | No | 91282CKG5 | 04/01/2024 | 4.235% | 4.125% | $99.508988 |

| 7-Year | No | 91282CKF7 | 04/01/2024 | 4.185% | 4.125% | $99.639057 |

| 10-Year | Yes | 91282CJZ5 | 03/15/2024 | 4.166% | 4.000% | $98.656761 |

Oops - looks like I forgot last week. Things have been pretty hectic recently. I've got some travel coming up off and on so my postings will probably continue to be sporadic.

In the meantime you can check for auction results here. I usually look Thursday afternoon or Friday as all the auctions for the week complete by then.

https://www.treasurydirect.gov/auctions/upcoming/ then click on the "Auction Results" tab.

The 52-week auction is next week and this afternoon the yields on treasuries maturing in one year is around 5.2%. Auction yields for the 52 week T-bill should end up in that neighborhood unless something changes between now and Tuesday. Very tempting even if it comes in a few basis points lower.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

The 52-week rate really popped today!

Rates popped across the board. Even the 2-year came within a few basis points of hitting 5%.The 52-week rate really popped today!

Sojourner

Thinks s/he gets paid by the post

- Joined

- Jan 8, 2012

- Messages

- 2,603

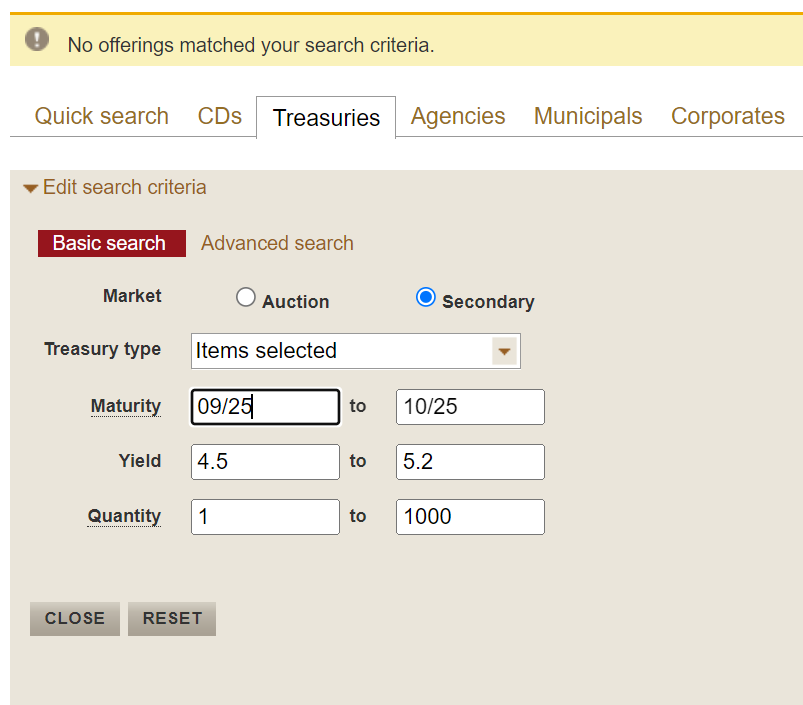

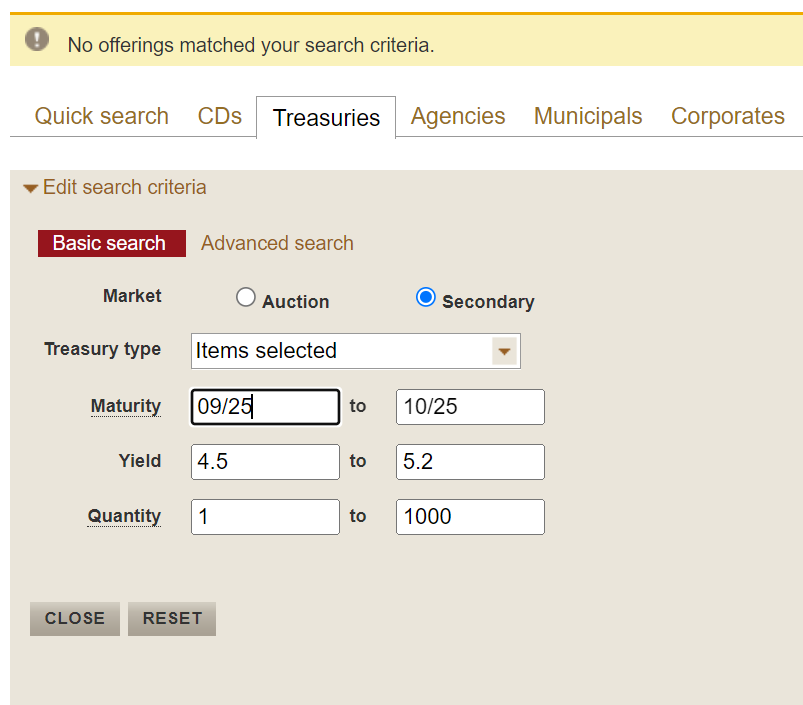

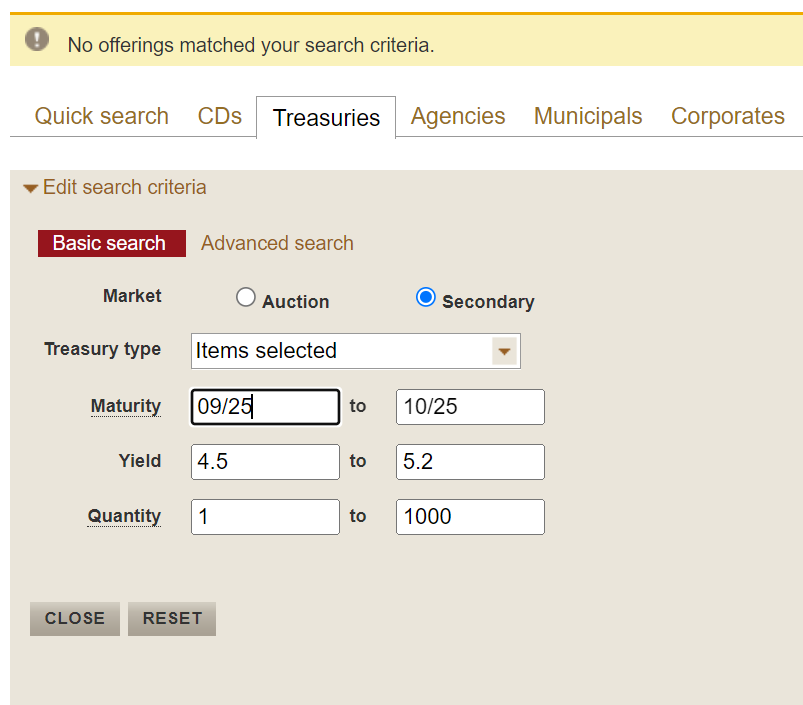

Trying to use Vanguard's treasury search tool, but no matter what I put in it always says "No offerings match your search criteria". What am I doing wrong here? I've tried entering a variety of values in the different fields, all to no avail. In the particular search shown below, I'm looking for 18mo treasuries with yields around 5.0%.

jollystomper

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Apr 16, 2012

- Messages

- 6,188

Trying to use Vanguard's treasury search tool, but no matter what I put in it always says "No offerings match your search criteria". What am I doing wrong here? I've tried entering a variety of values in the different fields, all to no avail. In the particular search shown below, I'm looking for 18mo treasuries with yields around 5.0%.

Try it without the quantity entries? I tested the search without it and came up with 8 items. You can always see the price for the minimum quantity desired under each retrieved result.

Sojourner

Thinks s/he gets paid by the post

- Joined

- Jan 8, 2012

- Messages

- 2,603

Try it without the quantity entries? I tested the search without it and came up with 8 items. You can always see the price for the minimum quantity desired under each retrieved result.

Yep, that did the trick. Thanks!

disneysteve

Thinks s/he gets paid by the post

- Joined

- Feb 10, 2021

- Messages

- 2,378

Just use the quick search function and select the 2 years tab. I find that much easier.Trying to use Vanguard's treasury search tool, but no matter what I put in it always says "No offerings match your search criteria". What am I doing wrong here? I've tried entering a variety of values in the different fields, all to no avail. In the particular search shown below, I'm looking for 18mo treasuries with yields around 5.0%.

Chuckanut

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Today's 5 year TIPS came in at a Real Yield of 2.242%. The coupon was 2.125%. The breakeven inflation rate for fixed rate 5 year Treasuries is 2.44%.

While not as high as last October, the real yield is still the 2nd highest since 2008. I like a real yield above 2%. As one who thinks the glide path to 2% inflation will be longer and rougher than expected, the breakeven rate seems good. Time will tell.

TipsWatch has these details and more.

While not as high as last October, the real yield is still the 2nd highest since 2008. I like a real yield above 2%. As one who thinks the glide path to 2% inflation will be longer and rougher than expected, the breakeven rate seems good. Time will tell.

TipsWatch has these details and more.

Last edited:

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

This week’s T-bill auction results:

Rates moved up this week and the 52-week really popped.

| Bills | CMB | CUSIP | Issue Date | High Rate | Investment Rate | Price per $100 |

| 4-Week | No | 912797JX6 | 04/23/2024 | 5.280% | 5.375% | $99.589333 |

| 8-Week | No | 912797KF3 | 04/23/2024 | 5.275% | 5.393% | $99.179444 |

| 13-Week | No | 912797JS7 | 04/18/2024 | 5.250% | 5.395% | $98.672917 |

| 17-Week | No | 912797KY2 | 04/23/2024 | 5.240% | 5.406% | $98.267889 |

| 26-Week | No | 912797KU0 | 04/18/2024 | 5.155% | 5.366% | $97.393861 |

| 52-Week | No | 912797KS5 | 04/18/2024 | 4.915% | 5.177% | $95.030389 |

Rates moved up this week and the 52-week really popped.

Last edited:

Trailwalker

Full time employment: Posting here.

- Joined

- Mar 19, 2021

- Messages

- 626

Today's 5 year TIPS came in at a Real Yield of 2.242%. The coupon was 2.125%. The breakeven inflation rate for fixed rate 5 year Treasuries is 2.44%.

While not as high as last October, the real yield is still the 2nd highest since 2008. I like a real yield above 2%. As one who thinks the glide path to 2% inflation will be longer and rougher than expected, the breakeven rates seems good. Time will tell.

TipsWatch has these details and more.

I agree that the real yield is very attractive. TIPs are already a heavy component in our 4-9year investment strategy so I'm not a buyer at this time. If the fixed yield stays high, I may add another step to our ladder next fall.

Similar threads

- Replies

- 457

- Views

- 52K

- Replies

- 15

- Views

- 7K

- Replies

- 3K

- Views

- 371K