Vincenzo Corleone

Full time employment: Posting here.

- Joined

- Jul 20, 2005

- Messages

- 617

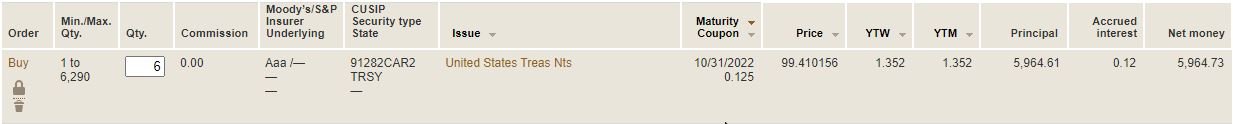

Would someone kindly help me make sense of this. I was in the process of using Vanguard's bond ladder tool. The attached photo is a snippet of one of the bonds in the ladder.

The quantity in the example provided is 6, and the price is 99.410156. How are the principal and "net money" amounts calculated? It looks to me the quantity is not 6 but 60. I'm clearly not getting how this works.

Thanks.

The quantity in the example provided is 6, and the price is 99.410156. How are the principal and "net money" amounts calculated? It looks to me the quantity is not 6 but 60. I'm clearly not getting how this works.

Thanks.

Attachments

Last edited: