- Joined

- Jul 1, 2017

- Messages

- 5,849

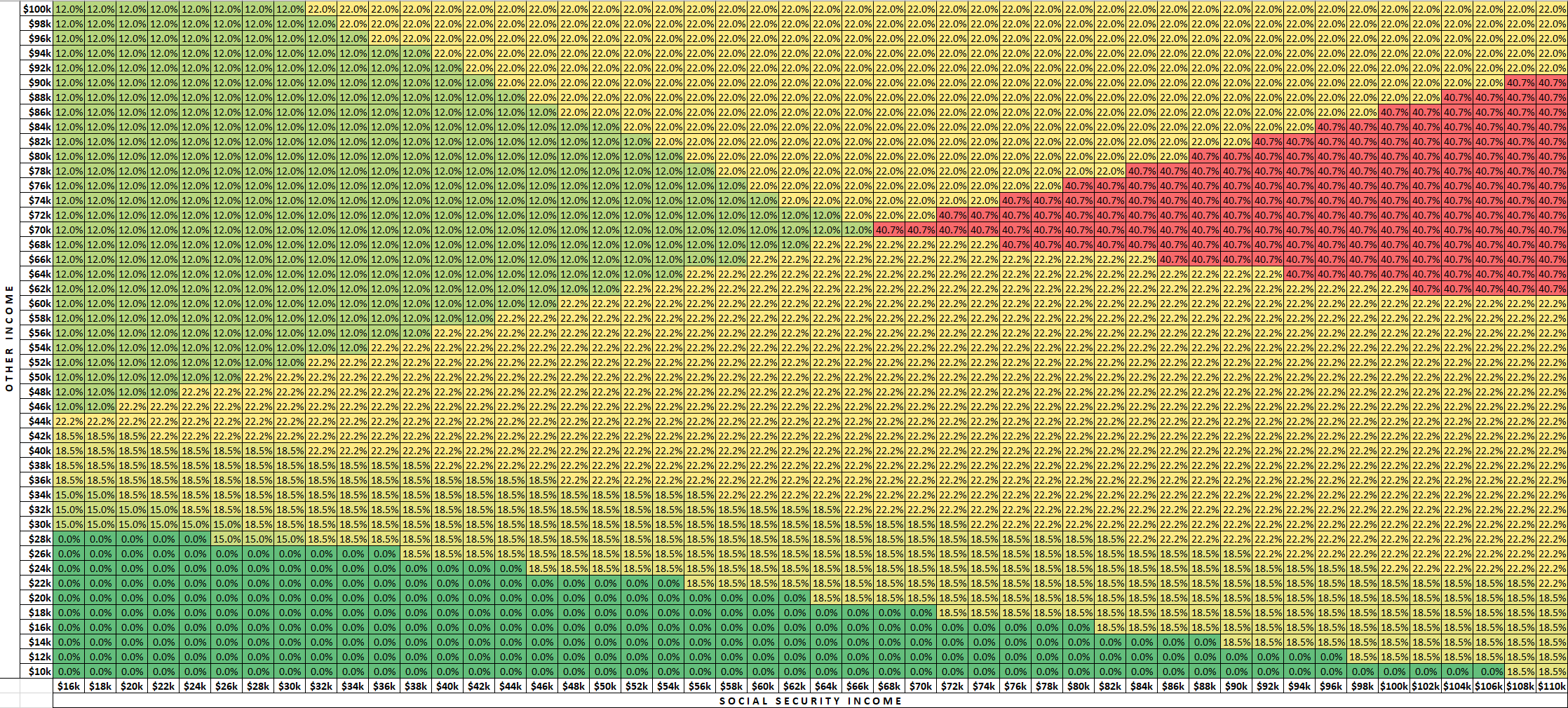

Did my last pre-Christmas Roth conversions. Today's conversions were cash.

Will need to tweak next week.

Next year, I will need to map out my conversion strategy in advance, for conversions in kind - and stick to it.

Will need to tweak next week.

Next year, I will need to map out my conversion strategy in advance, for conversions in kind - and stick to it.