You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Vanguard tax forms ready

- Thread starter bizlady

- Start date

MisterBill

Recycles dryer sheets

We just got an email that our Vanguard 1099R forms are ready for download… Just an FYI for others that might want them early

I'm sure that is very dependant on what funds/ETFs you own. Fidelity told me that my tax forms won't be available until 1/21.

SecondCor521

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

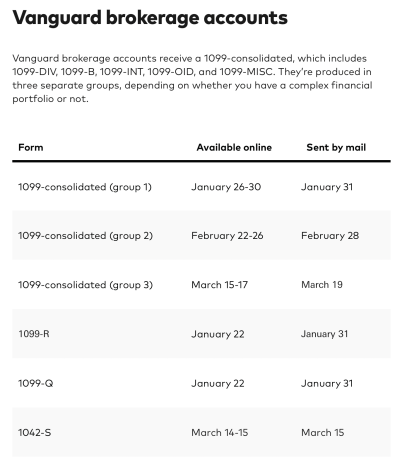

I am waiting on several tax forms from Vanguard. Of the five, only one is available now, and the other five vary in their availability dates. Vanguard does list when to expect them, though, which is nice.

MisterBill

Recycles dryer sheets

Yes, Fidelity does this as well. It's based on when each fund plans to make them available.I am waiting on several tax forms from Vanguard. Of the five, only one is available now, and the other five vary in their availability dates. Vanguard does list when to expect them, though, which is nice.

OverThinkMuch

Recycles dryer sheets

- Joined

- May 11, 2016

- Messages

- 313

Most people still need to wait for 1099-DIV. If you bought an ETF in early December and received dividends, you could retroactively change the tax rate on those dividends in January. There's a holding period that determines the tax rate, which is why all brokers have to wait and see what investors do.

FANOFJESUS

Thinks s/he gets paid by the post

Most people still need to wait for 1099-DIV. If you bought an ETF in early December and received dividends, you could retroactively change the tax rate on those dividends in January. There's a holding period that determines the tax rate, which is why all brokers have to wait and see what investors do.

When does that usually come out?

When does that usually come out?

I'm not familiar with the type of change other poster mentioned, so will defer on that. I do think that 1099-div are now supposed to be issued by end of January. REITs?BDCs/MLPs have some specific tax rules that often make them run late. They used to be up into March, then it changed to mid-February. It cascades if a broker holds an asset that holds another, etc.

May also not apply to those that have K1 instead of 1099.

Real estate transactions that close (or don't) right at end of year can cause some ripple effects.

1099-R should be easiest. Then mutual funds held by mutual fund provider (not a broker). Those are usually no later than mid-January (in fact, often after the long weekend).

MissMolly

Thinks s/he gets paid by the post

- Joined

- Jun 9, 2010

- Messages

- 2,141

Here is a link to Vanguard's Tax Form schedule

https://investor.vanguard.com/investor-resources-education/taxes/investment-tax-forms

https://investor.vanguard.com/investor-resources-education/taxes/investment-tax-forms

Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Even easier (below). I'll be waiting into Feb as usual. Getting one/some early doesn't really help much, getting the last one is what matters most to me.Here is a link to Vanguard's Tax Form schedule

https://investor.vanguard.com/investor-resources-education/taxes/investment-tax-forms

On a related topic, my TT state form download has been pushed out (again) to Jan 20. That's the latest I can recall, but without all my 1099's et al it doesn't hold me up anyway.

Attachments

Last edited:

FANOFJESUS

Thinks s/he gets paid by the post

So would a typical three fund portfolio at vanguard have them by the end of January?

Not if the funds are held in a brokerage account, then probably ~ 3rd week of Feb.So would a typical three fund portfolio at vanguard have them by the end of January?

More than once I have gotten corrected VG statements in March. Although, if you reconcile the tax statement to the financial statement the chance of an error is lower.

FANOFJESUS

Thinks s/he gets paid by the post

Not if the funds are held in a brokerage account, then probably ~ 3rd week of Feb.

More than once I have gotten corrected VG statements in March. Although, if you reconcile the tax statement to the financial statement the chance of an error is lower.

Thanks so it looks like group 2