RonBoyd

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

i am an experienced message board vet - so i hit the ground running without the formalities.

And this extensive familiarity with the genre led you to that course of action? Hmmmmm.

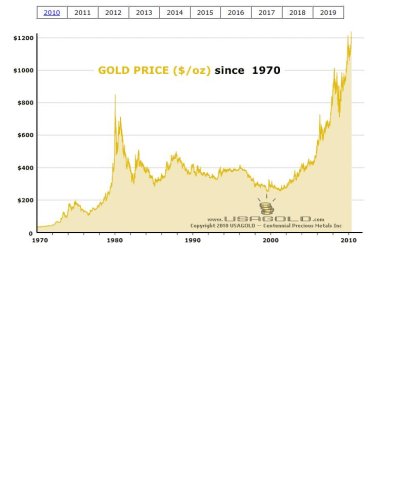

i think this community has it nailed down. the only thing i saw that was lacking was the discussion of the best performing asset of the last decade - precious metals.

Your knowledge of how this environment is structured is impressive. How we could have missed this marvelous facet of ER, I cannot imagine. Thank you for "straightening us out."

it's an important issue to me personally.

I noticed.

i feel like i've done my job.

There are others, of course, who share that opinion... most of them have already spoken.

now i can move on to learning about 72t, discussing income generating assets, rental real estate, etc.

Please do.