Christine

Full time employment: Posting here.

- Joined

- Dec 31, 2014

- Messages

- 670

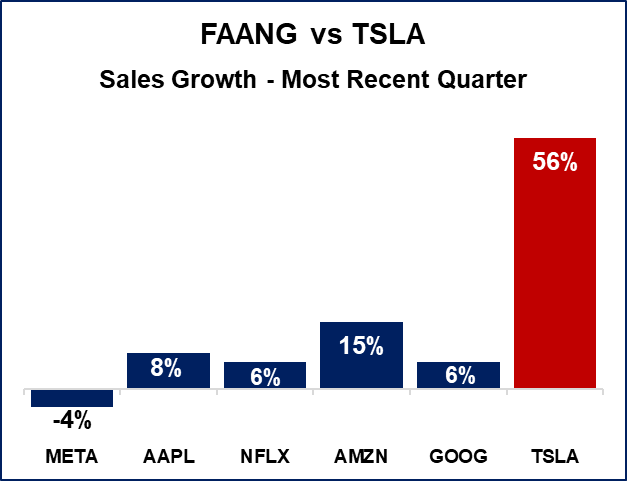

This surfaced on Twitter:

From:

Guidance:

META:

"Our community continues to grow and I'm pleased with the strong engagement we're seeing driven by progress on our discovery engine and products like Reels," said Mark Zuckerberg, Meta founder and CEO. "While we face near-term challenges on revenue, the fundamentals are there for a return to stronger revenue growth. We're approaching 2023 with a focus on prioritization and efficiency that will help us navigate the current environment and emerge an even stronger company."

AAPL:

Apple did not provide official guidance for its first fiscal quarter, which ends in December and contains Apple’s biggest sales season of the year. It hasn’t provided guidance since 2020, citing uncertainty.

NFLX:

We forecast Q4’22 operating margin of 4% vs. 8% in the year ago period. The fourth quarter is typically

our lowest operating margin quarter of the year as it’s usually our largest quarter in terms of content and

marketing spend. In addition, the aforementioned F/X impact has a high flow through to operating

income (~75%-80% of the revenue impact) as most of our costs are in US dollars. Excluding the

year-over-year impact of F/X, our Q4’22 operating margin forecast would be 10% vs. 8% in Q4’21.

AMZN:

Net sales are expected to be between $140.0 billion and $148.0 billion, or to grow between 2% and 8% compared with

fourth quarter 2021. This guidance anticipates an unfavorable impact of approximately 460 basis points from foreign

exchange rates.

• Operating income is expected to be between $0 and $4.0 billion, compared with $3.5 billion in fourth quarter 2021.

• This guidance assumes, among other things, that no additional business acquisitions, restructurings, or legal

settlements are concluded.

GOOG:

Alphabet didn't provide forward guidance.

TSLA:

We plan to grow our manufacturing capacity as quickly as possible. Over a multi-year horizon, we expect to achieve 50% average annual growth in vehicle deliveries. The rate of growth will depend on our equipment capacity, factory uptime, operational efficiency and the capacity and stability of the supply chain.

Disclaimer: I've already placed my bet.

From:

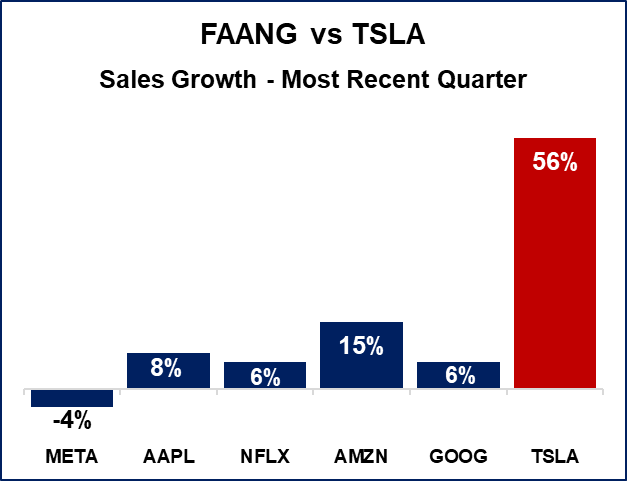

Guidance:

META:

"Our community continues to grow and I'm pleased with the strong engagement we're seeing driven by progress on our discovery engine and products like Reels," said Mark Zuckerberg, Meta founder and CEO. "While we face near-term challenges on revenue, the fundamentals are there for a return to stronger revenue growth. We're approaching 2023 with a focus on prioritization and efficiency that will help us navigate the current environment and emerge an even stronger company."

AAPL:

Apple did not provide official guidance for its first fiscal quarter, which ends in December and contains Apple’s biggest sales season of the year. It hasn’t provided guidance since 2020, citing uncertainty.

NFLX:

We forecast Q4’22 operating margin of 4% vs. 8% in the year ago period. The fourth quarter is typically

our lowest operating margin quarter of the year as it’s usually our largest quarter in terms of content and

marketing spend. In addition, the aforementioned F/X impact has a high flow through to operating

income (~75%-80% of the revenue impact) as most of our costs are in US dollars. Excluding the

year-over-year impact of F/X, our Q4’22 operating margin forecast would be 10% vs. 8% in Q4’21.

AMZN:

Net sales are expected to be between $140.0 billion and $148.0 billion, or to grow between 2% and 8% compared with

fourth quarter 2021. This guidance anticipates an unfavorable impact of approximately 460 basis points from foreign

exchange rates.

• Operating income is expected to be between $0 and $4.0 billion, compared with $3.5 billion in fourth quarter 2021.

• This guidance assumes, among other things, that no additional business acquisitions, restructurings, or legal

settlements are concluded.

GOOG:

Alphabet didn't provide forward guidance.

TSLA:

We plan to grow our manufacturing capacity as quickly as possible. Over a multi-year horizon, we expect to achieve 50% average annual growth in vehicle deliveries. The rate of growth will depend on our equipment capacity, factory uptime, operational efficiency and the capacity and stability of the supply chain.

Disclaimer: I've already placed my bet.

Last edited: