Gone4Good

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Sep 9, 2005

- Messages

- 5,381

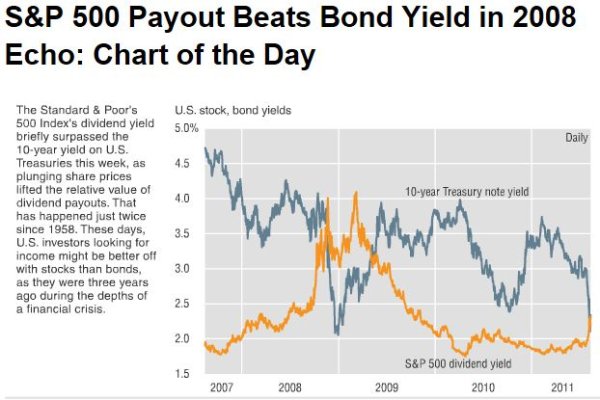

Relax. We are on the way to deflation. Depression follows.

The Fed is out of ammunition, no matter what Bernanke says. What can they do after interest rates are zero?

The Fed is out of political will, but has plenty of ammunition if there is a will to use it. With the God-Like powers to create unlimited money out of thin air, the Fed has deep enough pockets to buy every asset on earth. It can manufacture inflation if it wants to. It won't because such actions have risks, not least of which is to the Fed's independence.

Alternatively, if the Fed were to commit to a credible long-run inflation target of 3% to 4%, that would have the effect of reducing real rates below zero. It's announcement that rates will stay at zero to the middle of 2013 is a half step in that direction. This could be more effective policy than QE3.