Hi

I am 64, retired at 58 from megacorp with retirement health benefits. My DH is 63 and retired from the same megacorp at 60. No pensions. We both took SS at 62 for a total of $3900/mo. Fortunately we live in a LCOL southern state. We are enjoying our retirement immensely. We both ride e-bikes, he golfs, I swim. We have many social and fun activities in & outside of this beautiful 55+ active community.

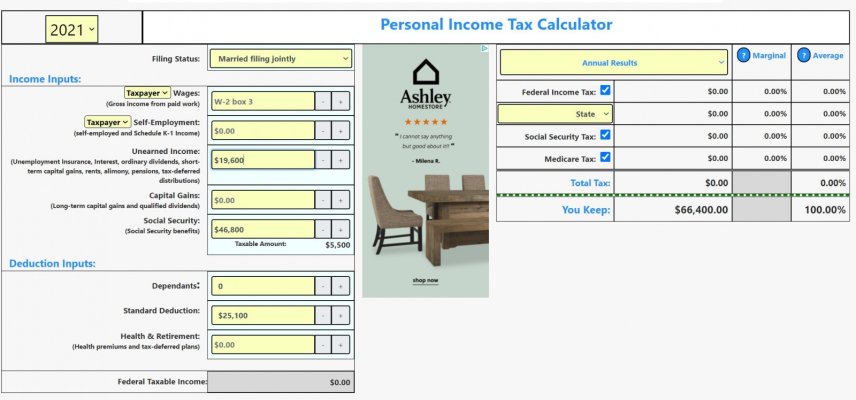

No debt, house paid off. We’ve travelled internationally in previous years and enjoyed it but we will be staying in the country for any future traveling for many reasons. We have 1.3M in Vanguard (we manage) with a 50/50 AA. We did an IRA to ROTH conversion last year, staying below taxable income but wondering if doing future conversions would even be worth doing? Our cash stash (>150K) pays for any extra expenses but we rarely exceed our SSA income. Just wondering if there are other folks in this community that are like us … very comfortable living on basically social security income only?

My brotherinlaw does but he lives in LCOL Delaware.

We are are in our 60's but waiting to collect our SS until age 70, so we are living off our savings.

I hope our financial guy knows what hes doing. He wants us to do a few Roth conversions for the next 3 years until my husband starts to collect SS. I don't see how it will be that worth it just for 3 years. Plus I was on an ACA plan for 5 months this year so have to keep our income low. I still don't get how much it will help. Not like we have 10 years until SS.