Q2 2023 update

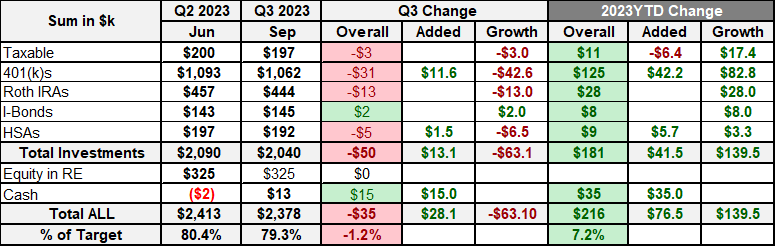

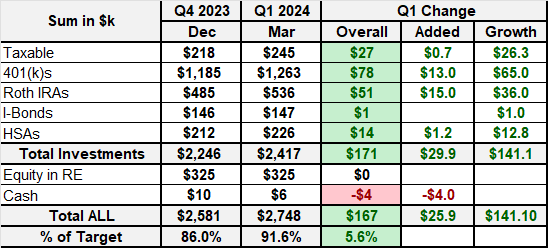

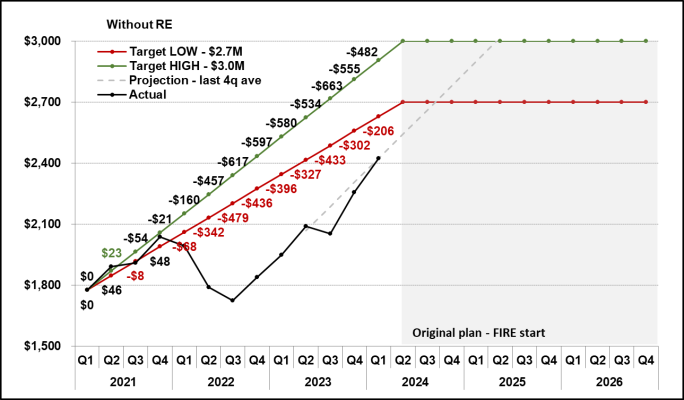

- We finished Q2 at all time high of $2,413k, 80.4% of the original target, booked green quarter with +$140k and +$251K YTD thanks to the market run up in the June.

- Cash position is still red but we are closing that gap slowly.

- My 401k contributions got capped for HCE, will be trying to bump up our after tax savings after we fund our Roth IRAs for this year.

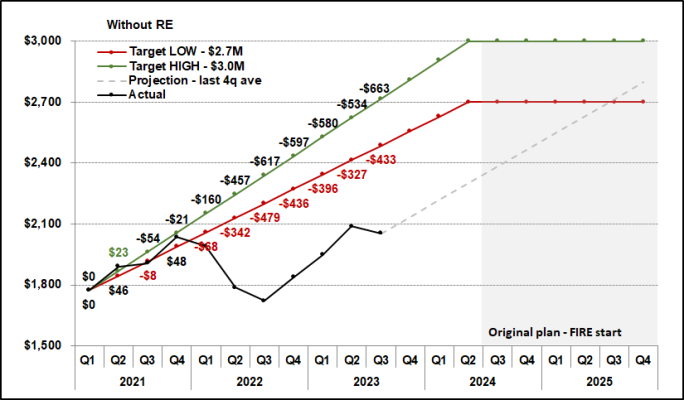

- Due to inflation and very red 2022 we are definitely behind, to retire in 4 Qs as we planned originally is out of the questions right now, will see if 6 Qs will get us to the finish line, that still can put us into the class of 2024

- We have 6Qs (?) to go...

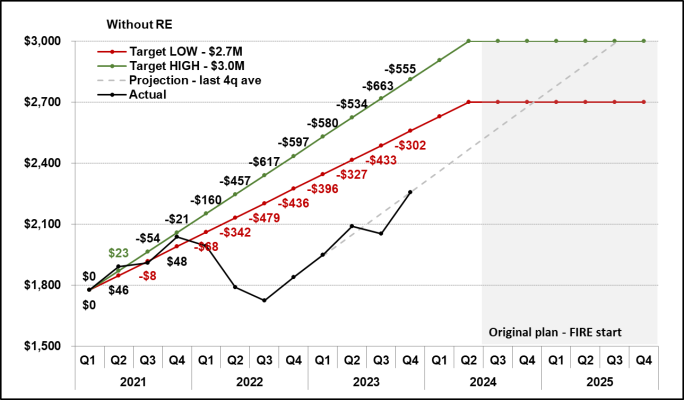

We are still running similar numbers. I am $2.56M still working towards $3M with a goal by May 2024. Up ~200K so far YTD. Market is still unpredictable but I am staying fulling invested in stocks hoping to hit the goal for next year. I thought there would be a recession by now but market seems to keep running so will ride it and hope market keeps doing opposite of what I was expecting.