Thanks,

madatrub it also looks crazy to me to read my first post here and see where we have been just 8 years ago and where we are now.

About your questions:

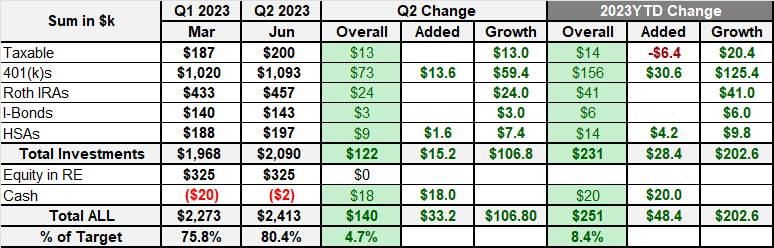

ROTHs - never did 401k Roths as we already have a sizable tax bite every year, so maxing out pretax 401k only. All our Roth IRA contributions since 2010 go through the "backdoor"

we maxing out them every year, it requires to file additional tax form but whole process is very simple and uneventful, we use Vanguard.

I also have 2 older Roths from the times when we have been eligible to contribute directly (2005-2009), back then I used those accounts to buy individual stock and tried to trade

As you can imagine I was not very good at that

and eventually just left couple position in each to sit and grow on its own. Both accounts had total $22k contributions and grew up to $205k as of end of Q2. I just got lucky I guess to have almost 10 fold gain - still holding those stocks

HSAs

HSAs - I got that question pretty often - how we amassed such amount in such type of accounts. Short answer - we started to contribute in 2006, first year when it was offered by our employers and since then have been maxing out every year and never took anything out. Almost whole amount is invested into the single ETF and you are correct - growth between 2020 and 2023 is partially due to contributions and rest is capital gains plus reinvested dividends. Nothing fancy here