5.3% YTD. Again, that's computed over every account, including all cash, even including even the checking account.

That's pretty darn good, so it makes me a bit worried that it may not last. So, I looked back at my diary and computed the gains in past years in the same first 51 days of the year.

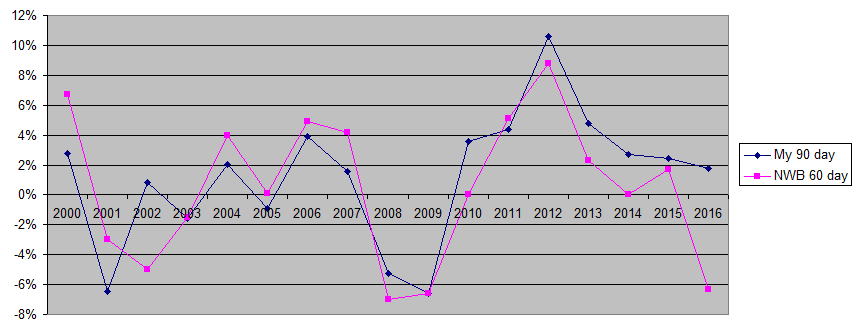

Here are some more numbers from my diary, showing the gains from Jan 1 to Feb 21 of the past years.

2000: 6.7%

2001: -3.0%

2002: -5.0%

2003: -1.5%

2004: 4.0%

2005: 0.1%

2006: 4.9%

2007: 4.2%

2008: -7.0%

2009: -6.6%

2010: 0.0%

2011: 5.1%

2012: 8.8%

2013: 2.3%

2014: 0.0%

2015: 1.7%

2016: -6.3%

2017: 5.3%

In that crazy year of 2000, I had a gain of 6.7%. That year did not end well.

But look at 2012. I forgot I had one heck of an early gain that year. But it soon plateaued out. I ended up the year 2012 with 10.8% gain, a mere 2% increase from that early gain.

So, what do I get from this? Not much other than anything can happen after the first couple of months of the year. I am going to hold or just continue to write more out-of-the-money covered calls until something develops that makes me want to sell.

We changed the beneficiary to me and I gave DSS a check for what the account was worth the day DH died. It's gone up by over $800 since that day.

We changed the beneficiary to me and I gave DSS a check for what the account was worth the day DH died. It's gone up by over $800 since that day.