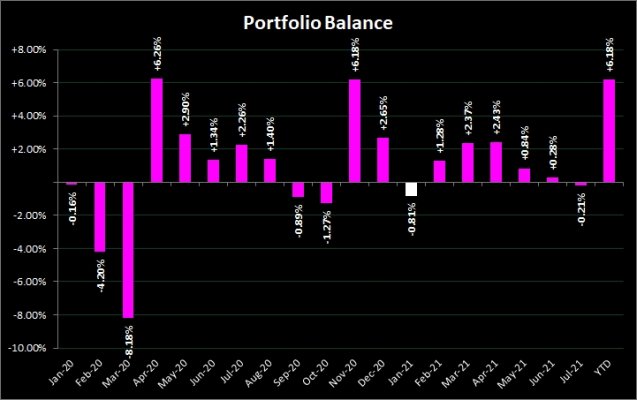

1.31 x 1.18 x 1.16 = 1.793

You made me look at my own records.

From 2019/1/1 till now, my stash grows 1.768X, using moneychimp formula. After WR, the balance still grow 1.719x. Wow!

My number is not too shabby, because I am never 100% invested. My stock AA ranged from 60% to 75-80% max. And I also have significant stinkin' international stocks, which trail the S&P.

While patting myself on the back, I also believe that this bull market simply cannot last forever. With a WR of less than 1%, I have room to blow dough, but have not found something worthwhile or the urge to do so.

PS. Records show that $10,000 invested in SPY on 2019/1/1 becomes $17,902 yesterday. With VT (Vanguard Total World Stock), it's $16,674.

Years from now, people who look back in history will not believe that the above market performance coincided with a world pandemic. There will be many scholarly articles written on this phenomenon.