You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

2021 Investment Performance Thread

- Thread starter robnplunder

- Start date

Lawrencewendall

Full time employment: Posting here.

Ytd + 16.98% 80/20

10.2%, but 52% stocks/22% cash. This is fantastic, since I'm purposefully low risk running into FWA for SS in 3.5 years.

I'm about to have a conversation with DW whens she's back from backpacking on the greenlight to spend more, considerably more. I know this doesn't sound like much to you 90/10 or 80% stock peeps, but this means our risk level has gone to almost....nothing, since I hit FWA pretty soon. That's factoring in a 40% market crash over the next 3 years, so we are (almost) 97% derisked (never say never) after a huge decline.

I've noticed international outperforming again the last two months, which has helped recently. Will be interesting to see if it continues, since there was a bit of this at the beginning of the year, then the S&P started outperforming again, as it has for years. So far over the last 4 years I've hit about the best possible outcome before SS, rather than mediocre or the bad case. Better to be lucky than good. I won't use the w*** word.

I'm about to have a conversation with DW whens she's back from backpacking on the greenlight to spend more, considerably more. I know this doesn't sound like much to you 90/10 or 80% stock peeps, but this means our risk level has gone to almost....nothing, since I hit FWA pretty soon. That's factoring in a 40% market crash over the next 3 years, so we are (almost) 97% derisked (never say never) after a huge decline.

I've noticed international outperforming again the last two months, which has helped recently. Will be interesting to see if it continues, since there was a bit of this at the beginning of the year, then the S&P started outperforming again, as it has for years. So far over the last 4 years I've hit about the best possible outcome before SS, rather than mediocre or the bad case. Better to be lucky than good. I won't use the w*** word.

Last edited:

Ronstar

Moderator Emeritus

9.1% on 50/50.

+16.7% YTD on 70/30.

RockyMtn

Thinks s/he gets paid by the post

Through August up 12% with a 62/36/2 allocation.

Jeffman52

Recycles dryer sheets

As of end of day yesterday, up 21.6% YTD.

SloHan

Recycles dryer sheets

- Joined

- Aug 13, 2017

- Messages

- 499

YTD up 17.19 %. AA 85/15.

NW-Bound

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 3, 2008

- Messages

- 35,712

Another month, another update

Jan 31: +0.35%

Feb 27: +7.37%

Mar 31: +10.24%

Apr 30: 12.4%, stock AA 76%

May 28: 15.74%, stock AA 79%

Jun 30: 17.89%, stock AA 78%

Jul 31: 17.62%, stock AA 79%

Aug 31: 19.47%, stock AA 77.8%

Sep 30: YTD 15.69%, stock AA 71.4%

In mid month, I was up better than 21%, but then all hell broke loose. I did manage to sell some shares off at the top to reduce my stock AA, but then the whole market dropped and brought down the stock AA for me. Bummer.

I could not help it, and sold many put options. Several will get assigned and will bring my stock AA back up a few percent, but not as high as 80% as it was earlier.

What works well this past month: energy, fertilizer, agricultural.

What tanks: semiconductor, industrial metal, mining, utilities, biotech, pharma, healthcare. Nearly everything is down, except for a few stocks.

Jan 31: +0.35%

Feb 27: +7.37%

Mar 31: +10.24%

Apr 30: 12.4%, stock AA 76%

May 28: 15.74%, stock AA 79%

Jun 30: 17.89%, stock AA 78%

Jul 31: 17.62%, stock AA 79%

Aug 31: 19.47%, stock AA 77.8%

Sep 30: YTD 15.69%, stock AA 71.4%

In mid month, I was up better than 21%, but then all hell broke loose. I did manage to sell some shares off at the top to reduce my stock AA, but then the whole market dropped and brought down the stock AA for me. Bummer.

I could not help it, and sold many put options. Several will get assigned and will bring my stock AA back up a few percent, but not as high as 80% as it was earlier.

What works well this past month: energy, fertilizer, agricultural.

What tanks: semiconductor, industrial metal, mining, utilities, biotech, pharma, healthcare. Nearly everything is down, except for a few stocks.

Last edited:

robnplunder

Thinks s/he gets paid by the post

Up 5.5%. All my mutual funds are underperforming the S&P 500. Sigh.

September was a bit of a downer - currently at 14.96% with 78/19/3 AA.Portfolio up 19.13% YTD with 79/19/2 AA.

target2019

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

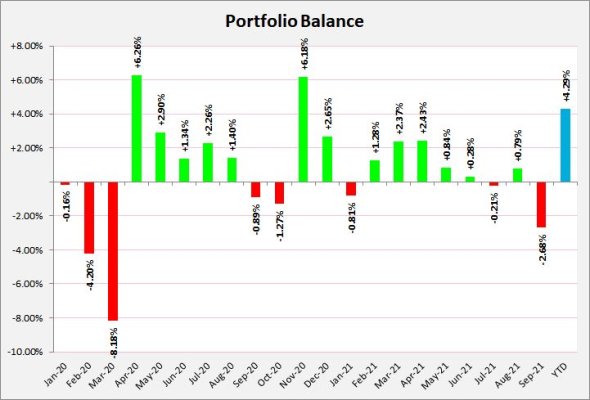

September 2021August 2021

Just the swings of total portfolio value...

YTD return for actively managed 50/50 port is 10.82% (RLBGX).

Cash is being inserted in the Wedding "Blow That Dough" category.

This month the market paid for a band and photographer Lol!

YTD return for an actively managed 50/50 port is 8.98% (RLBGX).

Cash and gifts joyfully given over to the DWZ (Die With Zero) category.

This month the market gave us nothing and took a few months back!

Still have more than the end of last year.

Attachments

Andre1969

Thinks s/he gets paid by the post

Here's my monthly check-in:

Jan 2021: -0.69% YTD

Feb 2021: +2.06% YTD

Mar 2021: +3.71% YTD

Apr 2021: +8.61% YTD

May 2021: +7.78% YTD

Jun 2021: +9.86% YTD

Jul 2021: +11.90% YTD

Aug 2021: +14.13% YTD

Sep 2021: +9.95% YTD

September started off pretty good. By 9/3 I was up 15.29% YTD. But then it started eroding. By 9/20 I was down to 11.13%. Clawed back up a bit, to 13.54% on 9/23, but then the end was rough.

Anyway, for those of you looking for that 5+% correction, there it is! For me, it was 9/3 to 9/30. And who knows what fun times are in store for today!

Jan 2021: -0.69% YTD

Feb 2021: +2.06% YTD

Mar 2021: +3.71% YTD

Apr 2021: +8.61% YTD

May 2021: +7.78% YTD

Jun 2021: +9.86% YTD

Jul 2021: +11.90% YTD

Aug 2021: +14.13% YTD

Sep 2021: +9.95% YTD

September started off pretty good. By 9/3 I was up 15.29% YTD. But then it started eroding. By 9/20 I was down to 11.13%. Clawed back up a bit, to 13.54% on 9/23, but then the end was rough.

Anyway, for those of you looking for that 5+% correction, there it is! For me, it was 9/3 to 9/30. And who knows what fun times are in store for today!

street

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Nov 30, 2016

- Messages

- 9,570

Plus 10.61% YTD.

Jan 21 + ?? I didn't check whoops

Feb 21 +1.58% after a pull-back

Mar 21 +8.26% Not a bad month but still trailing all 3 major indexes

Apr 21 Not sure what I was at in between jobs didn't have time to mark it down

May 21 +9.3% and hoping to get my 401k contributions going again with a new job and >120 months to ER ignition.

Jun 21 +15% 100% equities. Got an early 40th bday present beating all 3 indices, crossed another milestone. Big party, big presents, big fun! 119months to ER liftoff.

Jul 21 +16.8% Easy update. Still 100% equity portfolio. >118mo to ER.

Aug 21 +21%. Beating all 3 major, DJI,SP500,Nasdaq

Sep 21 +14.5%. the markets giveth, and the markets taketh. Used some dry powder this week.

Feb 21 +1.58% after a pull-back

Mar 21 +8.26% Not a bad month but still trailing all 3 major indexes

Apr 21 Not sure what I was at in between jobs didn't have time to mark it down

May 21 +9.3% and hoping to get my 401k contributions going again with a new job and >120 months to ER ignition.

Jun 21 +15% 100% equities. Got an early 40th bday present beating all 3 indices, crossed another milestone. Big party, big presents, big fun! 119months to ER liftoff.

Jul 21 +16.8% Easy update. Still 100% equity portfolio. >118mo to ER.

Aug 21 +21%. Beating all 3 major, DJI,SP500,Nasdaq

Sep 21 +14.5%. the markets giveth, and the markets taketh. Used some dry powder this week.

jimbee

Thinks s/he gets paid by the post

- Joined

- Oct 11, 2010

- Messages

- 1,229

Up 6.75% YTD, asset allocation is 50/50.

Last edited:

RetireAge50

Thinks s/he gets paid by the post

- Joined

- Aug 6, 2013

- Messages

- 1,660

12.6% AA 75/0/25

My crystal ball shows the market currently overvalued by 8.8%. If the market usually goes up 10%/year we should be back to normal by late next year.

My crystal ball shows the market currently overvalued by 8.8%. If the market usually goes up 10%/year we should be back to normal by late next year.

Spanky

Thinks s/he gets paid by the post

12.6% AA 75/0/25

My crystal ball shows the market currently overvalued by 8.8%. If the market usually goes up 10%/year we should be back to normal by late next year.

Are you going tp follow your crystal ball?

Spanky

Thinks s/he gets paid by the post

Ytd: 8.63%

- Joined

- Oct 13, 2010

- Messages

- 10,766

Back to May levels. +8.2% YTD, all-in.

Everything was down. Not one shining star in the bunch. Gold, REIT, utilities down, right along side regular domestic and international equities. Don't fall for that "one zigs, the other zags" thing. Bonds and college portfolio lost only 1%. I guess those could be the stars.

Everything was down. Not one shining star in the bunch. Gold, REIT, utilities down, right along side regular domestic and international equities. Don't fall for that "one zigs, the other zags" thing. Bonds and college portfolio lost only 1%. I guess those could be the stars.

Similar threads

- Replies

- 146

- Views

- 6K

- Sticky

- Replies

- 241

- Views

- 31K

- Replies

- 188

- Views

- 22K