I'm retiring next year at 59.5 (2023) and was thinking of getting a Lifetime annuity starting at 62.5 yrs old, because I don't have a pension and would expect some income stability to meet our monthly expenses.

Our monthly expenses this year (2022) is about $4000-$4100/mo including everything - housing, utility, food, travel, health insurance. (Just me and DW, no kids). And I expect when we get to the year 2026 (when I turn 62 yrs old), our monthly expenses will be around $4,800/mo with inflation. This $4,800/month includes about $12,000-$13,000 yearly travel expenses, which can be cut.

Was planning to get Social Security at 62 in 2026. Me and DW SS would be around approx. $3,600+/month with both our social security income. So, we have a shortfall of around $1,200/month which I might say is mostly our "travel budget", and so I thought of getting an annuity, and yes, I know that annuities does not adjust with inflation in the future - but as we age, we also may not travel that much into the future.

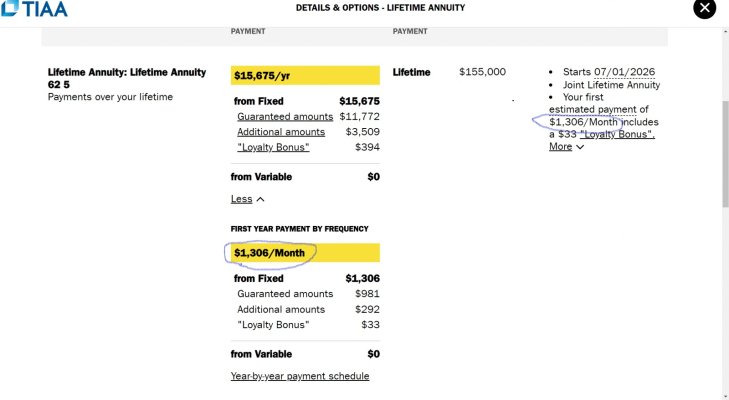

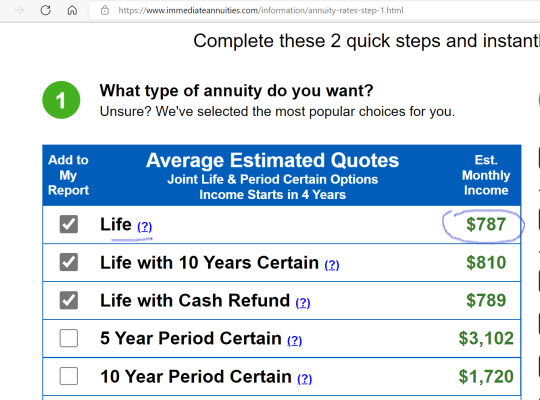

I called Tiaa-cref and also went to their website to confirm it, and I'm attaching the screenshots. Was going to put in $155K into a Lifetime annuity w/ a 10 year guarantee that if we pass away before 10 years, we can assign it to a beneficiary. The $155K will generate $1,306/month ($981 guaranteed + other amounts - these are premiums since I've been with Tiaa-cref for more than 23 years). In contrast, the $155K will only get me $787/month in ImmediateAnnuities.com.

So, our SS income of $3600/mo + Lifetime annuity of 1300/mo = $4,900/month in income.

So, with the annuity, we do not need to dip into my 401K savings until I need to buy big items like a new car or home repair.

What do you guys think ... $155K = $1,306/monthly income ? Good deal ?

Our monthly expenses this year (2022) is about $4000-$4100/mo including everything - housing, utility, food, travel, health insurance. (Just me and DW, no kids). And I expect when we get to the year 2026 (when I turn 62 yrs old), our monthly expenses will be around $4,800/mo with inflation. This $4,800/month includes about $12,000-$13,000 yearly travel expenses, which can be cut.

Was planning to get Social Security at 62 in 2026. Me and DW SS would be around approx. $3,600+/month with both our social security income. So, we have a shortfall of around $1,200/month which I might say is mostly our "travel budget", and so I thought of getting an annuity, and yes, I know that annuities does not adjust with inflation in the future - but as we age, we also may not travel that much into the future.

I called Tiaa-cref and also went to their website to confirm it, and I'm attaching the screenshots. Was going to put in $155K into a Lifetime annuity w/ a 10 year guarantee that if we pass away before 10 years, we can assign it to a beneficiary. The $155K will generate $1,306/month ($981 guaranteed + other amounts - these are premiums since I've been with Tiaa-cref for more than 23 years). In contrast, the $155K will only get me $787/month in ImmediateAnnuities.com.

So, our SS income of $3600/mo + Lifetime annuity of 1300/mo = $4,900/month in income.

So, with the annuity, we do not need to dip into my 401K savings until I need to buy big items like a new car or home repair.

What do you guys think ... $155K = $1,306/monthly income ? Good deal ?

Attachments

Last edited: