mathjak107

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jul 27, 2005

- Messages

- 6,208

My employer went bankrupt when I was 58. I started collecting SS at 62. I've been living off my SS, my annuity payments and now my IRA RMD's since then. Let me understand this. Are you suggesting that those who lose their jobs prior to retirement age without any income at all, start liquidating investments and live off their savings until 70? Just asking.

That isn’t the same situation…..

I retired at 61 and was going to delay to 70 …

But we were fronting our selves the ss we were not getting plus the regular draw from our portfolio.

That was extra ss money we were laying out was money that could be invested or was invested .

I was working one day a week enjoying what I did but I made to much to collect .

So I decided that since in the year I would be fra I could earn a lot more so I filed at 65 .

Even though I had planned to wait until 70 , mentally it was hard to wait , mr ss check is banging on the door going use me .

So we did . Plus my wife couldn’t get 4500 a year in a spousal adder .

So everyone is going to have a different situation so there is no one answer .

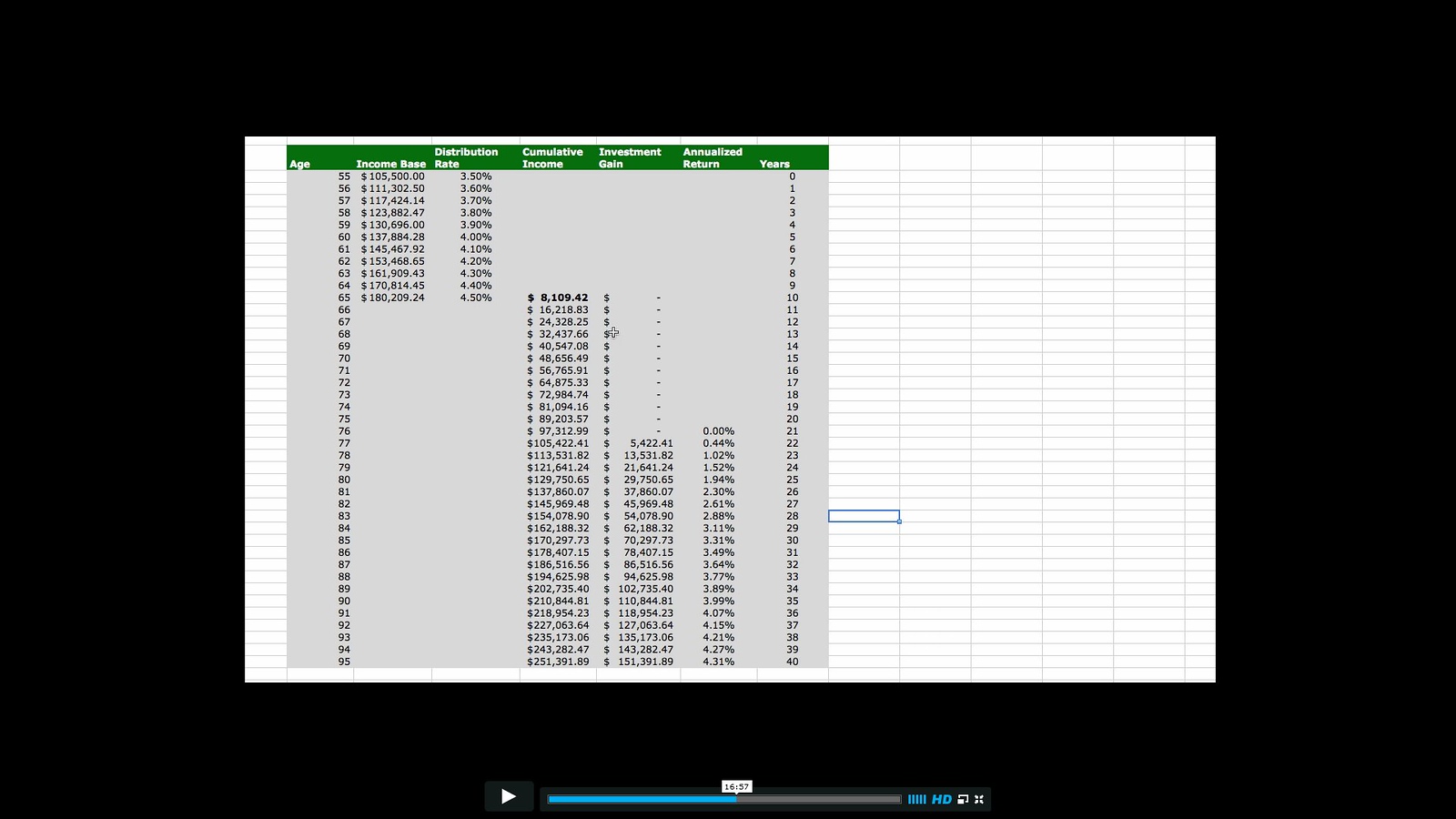

But if I had plans to buy an annuity I would have waited and spent down as it would be silly to spend more and get less then delaying gave me

Last edited: