Fermion

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

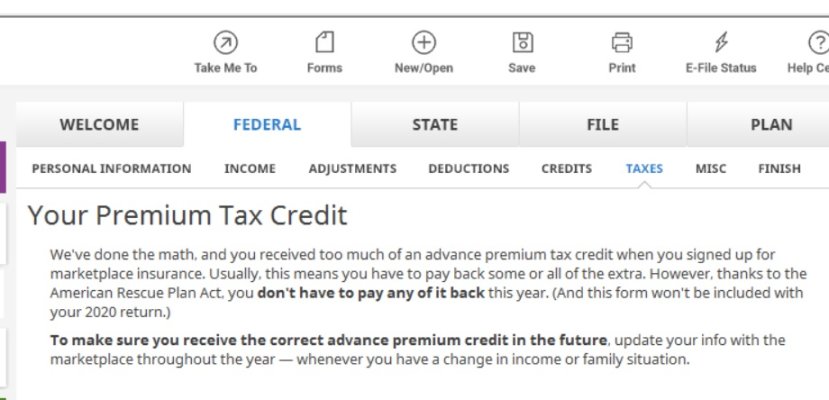

I am doing our taxes and using H&R Block software and even after updating it is putting in $10,500 owed for repayment of advance premium tax credit on our ACA policy.

I am not sure how to make it subtract that out. I am assuming they have just not updated the software yet to delete the repayment requirement for 2020 (special case of the relief law signed March 11).

I guess the right thing to do is wait to file? I had made enough estimated tax payments to cover this so would be getting a quite large refund if the software removes the $10,500 figure. Are any of the other software packages working correctly on this yet?

I am not sure how to make it subtract that out. I am assuming they have just not updated the software yet to delete the repayment requirement for 2020 (special case of the relief law signed March 11).

I guess the right thing to do is wait to file? I had made enough estimated tax payments to cover this so would be getting a quite large refund if the software removes the $10,500 figure. Are any of the other software packages working correctly on this yet?