You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best CD, MM Rates & Bank Special Deals Thread 2020 - Please post updates here

- Thread starter ShokWaveRider

- Start date

- Status

- Not open for further replies.

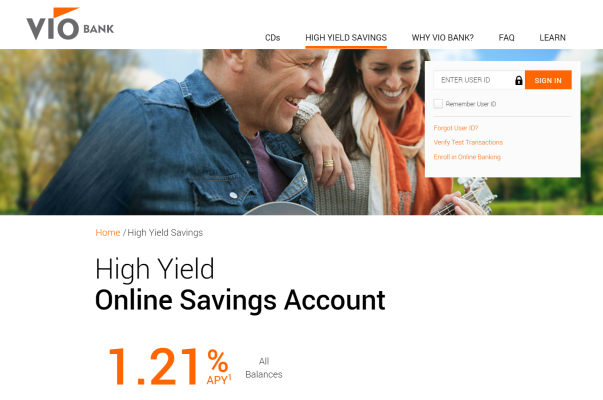

hrmm.. interesting.. so the front page says a lower value versus my actual account. I logged in and it lists the higher value. Maybe they havent updated it on the backend for those with accounts, at least the display.

Henry Lili

Recycles dryer sheets

- Joined

- Oct 18, 2009

- Messages

- 246

Two or three years ago I opened an Ascent Money Market account at Customer's Bank (min $25k has to be maintained). Throughout the time they would reset the rate and guarantee the rate for a variable amount of time. Last time was January when they locked the rate in at 2.25% APY through end of June. I expected a sizable cut and today received an e-mail that the APY will drop to 1.25% July 1st through end of the month. Still a very competitive rate. I don't believe they are offering this product to new customers any longer so glad I'm in.

Also super happy I locked in the 2.8% GTE 3yr add-on CD last August. Rolled $$'s from a maturing Navy FCU 3.25% into it last week so didn't lose to much interest. I intend to fill the GTE up to the insured max as CDs roll off the ladder.

Also super happy I locked in the 2.8% GTE 3yr add-on CD last August. Rolled $$'s from a maturing Navy FCU 3.25% into it last week so didn't lose to much interest. I intend to fill the GTE up to the insured max as CDs roll off the ladder.

gcgang

Thinks s/he gets paid by the post

- Joined

- Sep 16, 2012

- Messages

- 1,571

I’m maxed out at Ally, using the 11month no penalty at 1.35-1.50%. Looking for where to put additional funds.

Looked at CapOne. 1% on savings, less than that on CDs.

Doesn’t seem worth the bother to transfer around to earn 1% or less vs just leaving in my brokerage.

If I dared leave the house to do something, I could start to blow the dough. But not doing right now.

Maybe I’ll buy that Tesla - car, not the stock.

Looked at CapOne. 1% on savings, less than that on CDs.

Doesn’t seem worth the bother to transfer around to earn 1% or less vs just leaving in my brokerage.

If I dared leave the house to do something, I could start to blow the dough. But not doing right now.

Maybe I’ll buy that Tesla - car, not the stock.

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

Also super happy I locked in the 2.8% GTE 3yr add-on CD last August. Rolled $$'s from a maturing Navy FCU 3.25% into it last week so didn't lose to much interest. I intend to fill the GTE up to the insured max as CDs roll off the ladder.

Ditto. We opened the 4 year at GTE last year at 2.94% for 4 years and added the funds from our Navy Fed CD 3.25% which matured this week. Will add to it each year as our ladder matures until 2023 unless of course rates return to previous competitive terms.

Last edited:

Gotadimple

Thinks s/he gets paid by the post

- Joined

- Feb 17, 2007

- Messages

- 2,616

American Express High Yield Savings Account drops to 1.0% from 1.15% effective today. Unlike buying a 1% CD, these accounts are variable rate and can change at any time. Right now it looks like Amex has been adjusting their rate about once per month.

- Rita

- Rita

harley

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I recently tried to refinance one of my houses, and failed due to the debt/income ratio requirement. They (Chase) just won't take assets into consideration, no matter how much. Or maybe if we were in the 8 figure range they might make an exception, but a mere 7 figures doesn't cut it.

Combine that with the incredibly low rates for cash and bonds, and I'm seriously considering paying off one of the mortgages. The rate is 3.875%, which is pretty darn low, but I can't match it anymore. Unless I invest in equities, which I am expecting to tank for a significant period of time. Whether I'm right or wrong doesn't really matter, since it's too risky for me.

So I think I'll pay off the older and higher of the two. Then I can look into refinancing the other one at an even lower rate. I wonder how long the one will have to be off the books before it doesn't affect the other?

Edit: I was thinking about this because of what Brewer said in this thread about paying the mortgage, but if the mods think this would be better in the refinance thread feel free to move it.

Combine that with the incredibly low rates for cash and bonds, and I'm seriously considering paying off one of the mortgages. The rate is 3.875%, which is pretty darn low, but I can't match it anymore. Unless I invest in equities, which I am expecting to tank for a significant period of time. Whether I'm right or wrong doesn't really matter, since it's too risky for me.

So I think I'll pay off the older and higher of the two. Then I can look into refinancing the other one at an even lower rate. I wonder how long the one will have to be off the books before it doesn't affect the other?

Edit: I was thinking about this because of what Brewer said in this thread about paying the mortgage, but if the mods think this would be better in the refinance thread feel free to move it.

Last edited:

brewer12345

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Mar 6, 2003

- Messages

- 18,085

Harley, I am coming to a similar conclusion. I hate giving up liquidity, but at some point it makes no sense to keep paying the rate.

lucky penny

Full time employment: Posting here.

- Joined

- Jan 23, 2010

- Messages

- 735

American Express High Yield Savings Account drops to 1.0% from 1.15% effective today. Unlike buying a 1% CD, these accounts are variable rate and can change at any time. Right now it looks like Amex has been adjusting their rate about once per month.

- Rita

And their CD rates indicate what's expected next: e.g., .40% for 1 yr, .90% for 4 yrs, & you have to go to 5 yrs to get 1.10%.

Sunset

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

.....

Combine that with the incredibly low rates for cash and bonds, and I'm seriously considering paying off one of the mortgages. The rate is 3.875%, which is pretty darn low, but I can't match it anymore. Unless I invest in equities, which I am expecting to tank for a significant period of time. Whether I'm right or wrong doesn't really matter, since it's too risky for me.

....

I'd pay it off, why lose (pay out) about 3% extra than you take in, especially as the income side could be taxed reducing it more.

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I’m also looking at the mortgage as a place to dump some cash instead of zero rate savings. I’m looking to refi right now and it seems they’re ignoring IRA income on my application. I’d try some other lenders before settling for 3.875.

Hi All. Am coming close to receiving my bonus offer for the CapitalOne 360 offer and am looking for my next promotion for my cash possession. Was considering the Citi $700 promotion for holding $50K for 60 days. It seems to be the best one I can find. Any other recommendations or comments about the Citi offer?

https://banking.citi.com/cbol/check...1&ProspectID=F6F4BA3F9DF644DEA2DC6F97E9EE42F2

https://banking.citi.com/cbol/check...1&ProspectID=F6F4BA3F9DF644DEA2DC6F97E9EE42F2

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Hi All. Am coming close to receiving my bonus offer for the CapitalOne 360 offer and am looking for my next promotion for my cash possession. Was considering the Citi $700 promotion for holding $50K for 60 days. It seems to be the best one I can find. Any other recommendations or comments about the Citi offer?

https://banking.citi.com/cbol/check...1&ProspectID=F6F4BA3F9DF644DEA2DC6F97E9EE42F2

Seems like a great offer. Didn't see any catches.

Effective 8.4% rate for 2 months.

Seems like a great offer. Didn't see any catches.

Effective 8.4% rate for 2 months.

Thanks for having a look! I too think it seemed quite straight forward. They do note that it could take up to 90 days after the 60 day period to provide the promotion payment, and if you have less than the 50k in linked accounts (after the 60 days) they will charge you a monthly fee. I do not have anything else at Citi. I'm not sure if I could product switch after the 60 days to a lower tier account..and still be eligible for the promotion payment. I may inquire about that.

Thanks for having a look! I too think it seemed quite straight forward. They do note that it could take up to 90 days after the 60 day period to provide the promotion payment, and if you have less than the 50k in linked accounts (after the 60 days) they will charge you a monthly fee. I do not have anything else at Citi. I'm not sure if I could product switch after the 60 days to a lower tier account..and still be eligible for the promotion payment. I may inquire about that.

Please report back to us on that. Thanks,

Sneaky CapitalOne, as soon as I dropped the $100k in to the accounts for the $900 bonus, before the 6/30 deadline, they went from 1.15 to 0.8% on 7/1. So net bonus dropped from $687 to $600 over the 2% I’m still getting at DERI. Still worth it. I wonder if they knew they were going to drop well below the going rate for HY savings, and put out that offer to counter the expected exodus of cash.

Last edited:

jazz4cash

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Any other recommendations or comments about the Citi offer?

]

Is this offer from Chase still available?

https://www.doctorofcredit.com/chase-600-checking-savings-bonus/

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Thanks for having a look! I too think it seemed quite straight forward. They do note that it could take up to 90 days after the 60 day period to provide the promotion payment, and if you have less than the 50k in linked accounts (after the 60 days) they will charge you a monthly fee. I do not have anything else at Citi. I'm not sure if I could product switch after the 60 days to a lower tier account..and still be eligible for the promotion payment. I may inquire about that.

At the current ~ 1% online savings rate, the 5 month return would be $208, which is still ~ 500 less than the 700 bonus.

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

I looked at the Citi deal last fall and decided at the time that it wasn't worth it as the interest rate on the savings account that you needed to open was very low, compared to Citi's high yield savings account, which does not qualify as one of the two accounts you must open. Also assuming you move the money out as soon as possible, I would be assessed monthly maintenance fees unless I leave at least $15,000 in the accounts until the bonus is paid and you move all the funds out. At the time I didn't like getting practically nothing as a rate of return when I was receiving over 2% at Ally.

Now however, with HY rates low everywhere, it's more about the cash bonus. The $700 (less up to 3 monthly maintenance fees) looks pretty attractive. Will mull over doing this to see if it's worth all the hoops I'll have to jump through.

Also if this deal is through year end, I could do this twice with the same $50,000, once in my name, pull all but $1 out after 60 days, rinse and repeat in DH's name with the same $50,000. Total $1,400 less up to 6 monthly maintenance fees.

Now however, with HY rates low everywhere, it's more about the cash bonus. The $700 (less up to 3 monthly maintenance fees) looks pretty attractive. Will mull over doing this to see if it's worth all the hoops I'll have to jump through.

Also if this deal is through year end, I could do this twice with the same $50,000, once in my name, pull all but $1 out after 60 days, rinse and repeat in DH's name with the same $50,000. Total $1,400 less up to 6 monthly maintenance fees.

Last edited:

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I looked at the Citi deal last fall and decided at the time that it wasn't worth it as the interest rate on the savings account that you needed to open was very low, compared to Citi's high yield savings account, which does not qualify as one of the two accounts you must open. Also assuming you move the money out as soon as possible, I would be assessed monthly maintenance fees unless I leave at least $15,000 in the accounts until the bonus is paid and you move all the funds out. At the time I didn't like getting practically nothing as a rate of return when I was receiving over 2% at Ally.

Now however, with HY rates low everywhere, it's more about the cash bonus. The $700 (less up to 3 monthly maintenance fees) looks pretty attractive. Will mull over doing this to see if it's worth all the hoops I'll have to jump through.

It is also getting to where the monthly online savings % is closer to the monthly maintenance fee, i.e. leave the monies in there for 5 months to avoid the fees.

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

Do you know offhand what the monthly fees are?It is also getting to where the monthly online savings % is closer to the monthly maintenance fee, i.e. leave the monies in there for 5 months to avoid the fees.

BeachOrCity

Full time employment: Posting here.

- Joined

- Jun 1, 2016

- Messages

- 892

Ditto. We opened the 4 year at GTE last year at 2.94% for 4 years and added the funds from our Navy Fed CD 3.25% which matured this week. Will add to it each year as our ladder matures until 2023 unless of course rates return to previous competitive terms.

Thanks for the reminder about the GTE account I opened. I just added my checking account to send them some $$$. Anyone know what the limit is for inbound $$$ transfer w/ GTE?

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

Thanks for the reminder about the GTE account I opened. I just added my checking account to send them some $$$. Anyone know what the limit is for inbound $$$ transfer w/ GTE?

$5,000 per day I believe. However if you initiate the transfer from the other institution I don't believe there is a limit. I pushed a large amount from Ally to GTE.

Last edited:

Golden sunsets

Thinks s/he gets paid by the post

- Joined

- Jun 3, 2013

- Messages

- 2,524

Do you know offhand what the monthly fees are?

I've concluded that for me it's not worth it, as the $50,000 would be coming out of an Ally no penalty CD paying 1.95%. The maintenance fee at Citi is $30 a month if keeping less than the $50,000 in for the 5 months that I would need to(60 days then 90 more days). So either a net bonus of $580 to $610 depending on the number of full months to avoid the maintenance fee. I then would not have the same 1.95% to put the money back into. Others may make a different choice depending on where the money is currently and what it is earning.

Dtail

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I've concluded that for me it's not worth it, as the $50,000 would be coming out of an Ally no penalty CD paying 1.95%. The maintenance fee at Citi is $30 a month if keeping less than the $50,000 in for the 5 months that I would need to(60 days then 90 more days). So either a net bonus of $580 to $610 depending on the number of full months to avoid the maintenance fee. I then would not have the same 1.95% to put the money back into. Others may make a different choice depending on where the money is currently and what it is earning.

Sorry for the lack of response. Was out playing Pickleball.

Agree with you in your situation.

However if one is in a not locked in current ~1% HYS account, then it could be worth it, with rates only going lower to even out against the fee vs. interest.

- Status

- Not open for further replies.

Similar threads

- Sticky

- Replies

- 267

- Views

- 33K

- Replies

- 457

- Views

- 52K

- Locked

- Replies

- 2K

- Views

- 384K

- Locked

- Replies

- 3K

- Views

- 335K