Spanky

Thinks s/he gets paid by the post

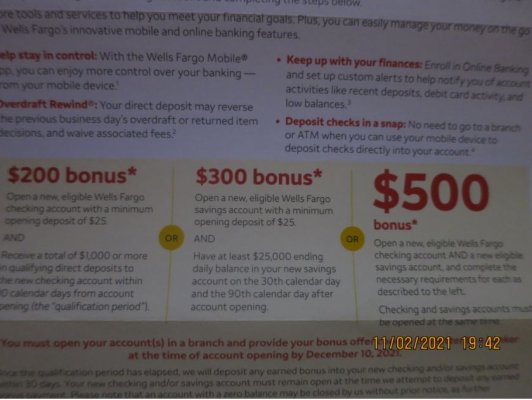

Might not be bad if doing both, depending how long you have to tie up the money. Other than the bonus you probably earn close to nothing on those.

But if I wanted a new national bank account that might make it more compelling.

tying up cash for 90 days for a $500 bonus is not too bad. Citibank offers another deal to earn up to $1,500 bonus https://banking.citi.com/cbol/prior...1&ProspectID=F735AC7B5C884ACA8C42CC36AEA8CD39.