What rate opportunities are available in 2022

You are using an out of date browser. It may not display this or other websites correctly.

You should upgrade or use an alternative browser.

You should upgrade or use an alternative browser.

Best CD, MM Rates & Bank Special Deals Thread 2022 - Please post updates here

- Thread starter MichaelB

- Start date

- Status

- Not open for further replies.

kabbage.com checking has 1.1%, but only up to $100K

That appears to be only for business acounts.

That appears to be only for business acounts.

They don't ask for any kind of documentation, and anybody can say they are a sole proprietor.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Just got an email from American Express Bank that the savings interest rate is increasing (back) to 0.5%.

John Galt III

Thinks s/he gets paid by the post

- Joined

- Oct 19, 2008

- Messages

- 2,803

I have $20,000 in PenFed 3.5% I think, CD's maturing Jan 8, 2022. Renewal rate would be only 1.50 %, for a 7 year term. Currently thinking of moving the $20K into PenFed's 'premium online savings' which is currently 0.5%. Will leave it there until something attractive comes along. Not ideal, but quick and easy, I hope. Will try it today, online, without calling them.

I have $20,000 in PenFed 3.5% I think, CD's maturing Jan 8, 2022. Renewal rate would be only 1.50 %, for a 7 year term. Currently thinking of moving the $20K into PenFed's 'premium online savings' which is currently 0.5%. Will leave it there until something attractive comes along. Not ideal, but quick and easy, I hope. Will try it today, online, without calling them.

I Bonds. You aren't gonna find anything better for the next year.

Beststash

Full time employment: Posting here.

- Joined

- Nov 8, 2003

- Messages

- 582

I have $20,000 in PenFed 3.5% I think, CD's maturing Jan 8, 2022. Renewal rate would be only 1.50 %, for a 7 year term. Currently thinking of moving the $20K into PenFed's 'premium online savings' which is currently 0.5%. Will leave it there until something attractive comes along. Not ideal, but quick and easy, I hope. Will try it today, online, without calling them.

I had the same situation on 01/01/22 and transferred to the Premium Online Savings because I can only transfer $5K daily from my regular savings using the menu transfer option but up to $25K per day from the Premium account using the menu transfer option.

Not sure if those numbers are just in my case or not.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

I Bonds. You aren't gonna find anything better for the next year.

Absolutely. $10k for Galt, $10k for Mrs. Galt = guaranteed minimum of 3.56% for 1 year when it can be withdrawn. In all likelihood, May rate reset will leave rate well above 0%, and thus 1 year return will be in excess of the 3.56%. Additionally the interest is state/local tax free.

Far in excess of whatever PenFed or any other savings account will provide.

They don't ask for any kind of documentation, and anybody can say they are a sole proprietor.

Careful, business accounrs do not receive the same level of fraud protection as personal accounts.

John Galt III

Thinks s/he gets paid by the post

- Joined

- Oct 19, 2008

- Messages

- 2,803

I Bonds. You aren't gonna find anything better for the next year.

Already did the i-bonds, thanks to this informative forum! Single guy. I did $10,000 in Dec, 2021, and just did $10,000 in Jan, 2022. I still have way too much in cash, around $80,000 ! But now $42,000 of that cash is earning 0.55% at PenFed, better than the 0.05% in my other savings place. Obviously I ought to move some more into PenFed premium at 0.55 %. Good problem to have, too much cash, lol. Not 'blowing that dough' enough I guess, ha ha.

Last edited:

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,249

I just scheduled an extra 4Q2021 tax year estimated payment of $5000 thru EFTPS to get a $5K I bond with my tax refund. I actually made it $5500 to make sure I get at least $5K refund. First year doing that. I already made my $10K purchase. Not setting up a trust for this though.I Bonds. You aren't gonna find anything better for the next year.

lucky penny

Full time employment: Posting here.

- Joined

- Jan 23, 2010

- Messages

- 735

I just scheduled an extra 4Q2021 tax year estimated payment of $5000 thru EFTPS to get a $5K I bond with my tax refund. I actually made it $5500 to make sure I get at least $5K refund. First year doing that. I already made my $10K purchase. Not setting up a trust for this though.

No rush to make I bond purchases since I believe interest accrues from the 1st of the month regardless when you make the purchase that month.

FYI, I just switched my Vio Bank accounts from their "high yield savings" to their money market. They are (and I called and asked) the same thing, but with two differences: 1) the name, and 2) the MM has a slightly higher interest (.51% vs .55%). So, I called and had the account converted (fairly painless).

Montecfo

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I just scheduled an extra 4Q2021 tax year estimated payment of $5000 thru EFTPS to get a $5K I bond with my tax refund. I actually made it $5500 to make sure I get at least $5K refund. First year doing that. I already made my $10K purchase. Not setting up a trust for this though.

Good move. But is it as simple as filing for an extension, paying $5k with it, and then diverting that to ibond?

Also if you know, can your broker be custodian of that ibond?

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,249

Yeah, I found that out too late. But it only cost me about $4 interest on 0.55% of interest on $10K for not waiting until late in the month.No rush to make I bond purchases since I believe interest accrues from the 1st of the month regardless when you make the purchase that month.

RunningBum

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- Jun 18, 2007

- Messages

- 13,249

Probably. What do you do, file for an extension and then immediately file the return to get that $5K refund in an I Bond? EFTPS is really easy if you've done it before. 5 minutes. Easier than an extension, I'd say. There's another way to make an estimated payment without an EFTPS account. I can't recall the name and I don't know if that's easier.Good move. But is it as simple as filing for an extension, paying $5k with it, and then diverting that to ibond?

I don't have any idea. My plan is to get the paper bond, and then try to do a SmartExchange to put it in my Treasury Direct account, or keep it in my fireproof lock box until I eventually redeem it at a bank.Also if you know, can your broker be custodian of that ibond?

Just got an email from American Express Bank that the savings interest rate is increasing (back) to 0.5%.

It’s about time. I finally closed out my Amex Savings account last year since they’ve always been slightly lower than their competitors.

Since then I’ve moved over to T-Mobile bank which pays 1%.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

No rush to make I bond purchases since I believe interest accrues from the 1st of the month regardless when you make the purchase that month.

Additionally, no matter when you purchase, you get the current rate for the first 6 months, then the next rate for 6 months, and so on.

That means, you can make purchases of I Bonds through April before the May rate reset, be guaranteed 7.12% for the initial 6 months and then the May reset rate for the following 6 months - even when that following 6 month period begins in October.

audreyh1

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I had the same situation on 01/01/22 and transferred to the Premium Online Savings because I can only transfer $5K daily from my regular savings using the menu transfer option but up to $25K per day from the Premium account using the menu transfer option.

Not sure if those numbers are just in my case or not.

Such low transfer limits go away when you use another bank or brokerage to initiate the transfer. Many have much higher transfer limits.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

aja8888

Moderator Emeritus

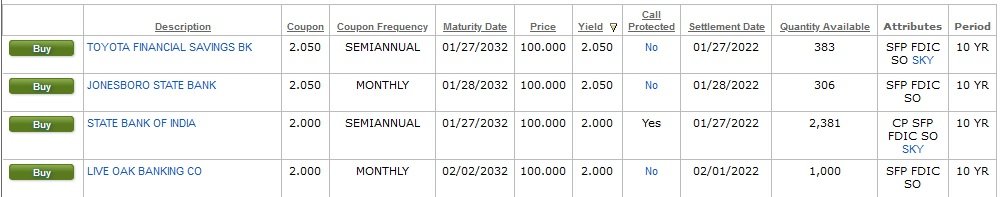

New issue 10-year brokered CDs at Fidelity 2.0%-2.05%

Ten years......ugh.

njhowie

Thinks s/he gets paid by the post

- Joined

- Mar 11, 2012

- Messages

- 3,931

Ten years......ugh.

The important point is that they are on the move...higher. It's double what it was a year ago.

I just did a quick check on depositaccounts.com and these 2% rates for 10 years are significantly higher than any they are showing.

Last edited:

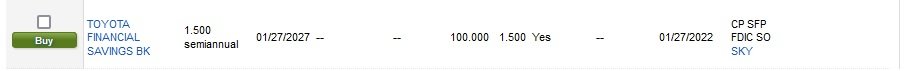

5 year Treasury is at 1.61% right now. Safer and no state income taxes.New issue call-protected 5-year brokered CD at Fidelity 1.5%

- Status

- Not open for further replies.

Similar threads

- Sticky

- Replies

- 244

- Views

- 31K

- Replies

- 457

- Views

- 52K

- Replies

- 35

- Views

- 3K

- Replies

- 303

- Views

- 9K