Markola

Thinks s/he gets paid by the post

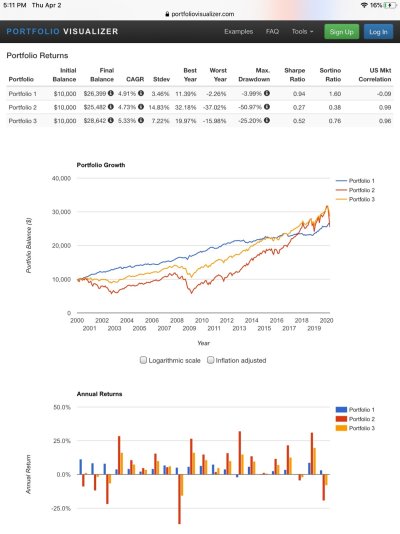

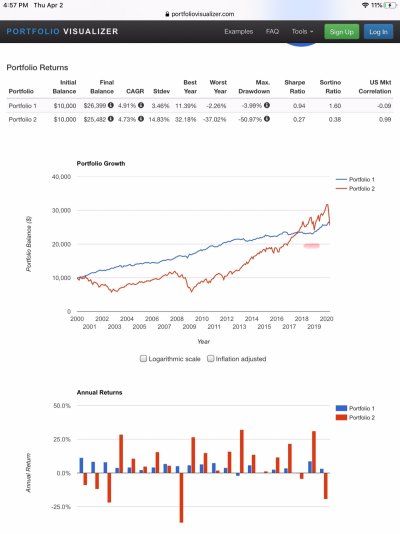

Investors are enchanted by stocks’ unique ability to grow, grow, grow. Turns out, it’s equally important to not fall, fall, fall.

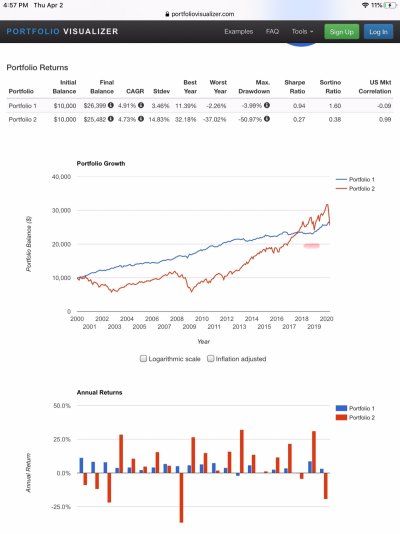

Portfolio 1 VBMFX = Vanguard Total Bond Index Fund

Portfolio 2 VFINX = Vanguard S&P 500

Maybe the safest and best strategy for a long term, buy and hold investor is to set the allocation at 50/50 and leave it alone?

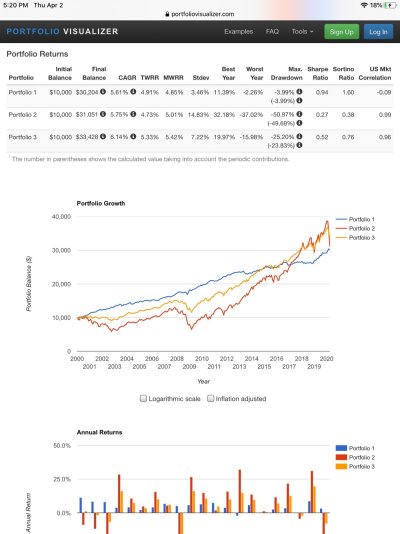

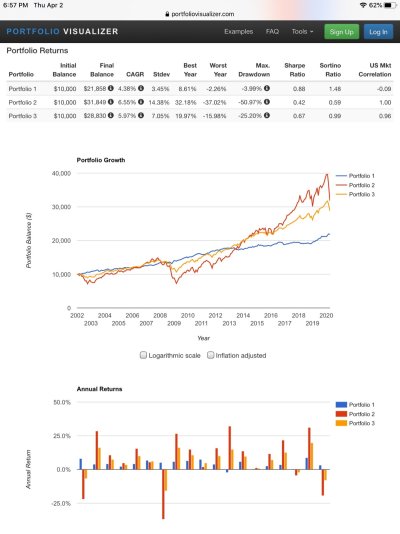

Portfolio 1 VBMFX = Vanguard Total Bond Index Fund

Portfolio 2 VFINX = Vanguard S&P 500

Maybe the safest and best strategy for a long term, buy and hold investor is to set the allocation at 50/50 and leave it alone?

Last edited: